“Within a year or so, residential housing problems should largely be behind us,” Buffett wrote yesterday in his annual letter to the shareholders of his Berkshire Hathaway Inc. “Prices will remain far below ‘bubble’ levels, of course, but for every seller or lender hurt by this there will be a buyer who benefits.”

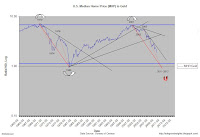

Buffett, highly leveraged to the housing market, is careful with his words. His words, like many of the market masters, reflect an understanding of the cycles in place. It's what he doesn't say and very well knows that I consider important. The end of the housing "woes" on paper, despite citation of supply and demand - economic factors, will come largely from currency devaluation. The down trend in the "real" or gold adjusted home sale price since 2001 reflects this dynamic. In other words, what is left unsaid is that gold, relative to housing will continue to outperform until at least 1:1 ratio is achieved. For example, if the median home sale price in 2012 falls between $225,000-$250,000, a price range that would be considered as easing of the woes from $203,000 in 2010, implies a gold price of $2,500-$2,700.

U.S. Median Home Price (MHP) to Gold:

Since this cycle was far more severe in terms of credit deterioration and home ownership penetration, I would not be surprised to see it extended in terms of time and price.

Source: bloomberg.com

0 comments:

Post a Comment