Real or Gold Adjusted Federal Total Receipts 12-Month Moving Average (TR12MA) AND Federal Total Receipts 12-Month Moving Average Year-over-Year Change (TW12MA12LN):

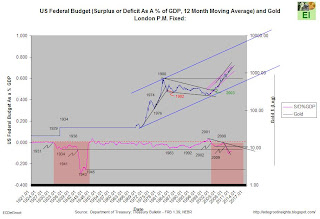

US Federal Budget (Surplus or Deficit As A % of GDP, 12 Month Moving Average) and Gold London P.M. Fixed:

Headline: U.S. households getting more from Uncle Sam than they pay in

With President Obama’s deficit-reduction plan now on the table, the political left, right and center are ready to rumble over how to assure long-term fiscal stability. The big questions are where to slash and by how much. But over the next year or two, the most important question for the economy might well be how quickly the cutting should begin. Households have become unusually dependent on the government for income support and removing that prop too fast could put the recovery at risk.

For the first time since the Great Depression, households are receiving more income from the government than they are paying the government in taxes. The combination of more cash from various programs, called transfer payments, and lower taxes has been a double-barreled boost to consumers’ buying power, while also blowing a hole in the deficit. The 1930s offer a cautionary tale: The only other time government income support exceeded taxes paid was from 1931 to 1936. That trend reversed in 1936, after a recovery was underway, and the economy fell back into a second leg of recession during 1937 and 1938.

Source: money.msn.com

From Bob

0 comments:

Post a Comment