Still, inflation is "going to be serious," Wal-Mart U.S. CEO Bill Simon said during a meeting with USA TODAY's editorial board. "We're seeing cost increases starting to come through at a pretty rapid rate."

Video

Still, inflation is "going to be serious," Wal-Mart U.S. CEO Bill Simon said during a meeting with USA TODAY's editorial board. "We're seeing cost increases starting to come through at a pretty rapid rate."

Ireland prepared to learn the full cost of its banking crisis on Thursday when the results of stress tests were expected to reveal that four banks need billions more in aid, likely giving the government extra ammunition in its campaign to force some of the losses on international investors.

As the results loomed, market tensions were at a high, forcing the suspension of trading in the shares of Bank of Ireland and Allied Irish Banks. Irish Life & Permanent and the Educational Building Society were also being tested.

A senior Irish banker, Mike Aynsley, said he expected the tests to conclude that the four lenders would need another euro18 billion to euro25 billion ($25 billion to $35 billion) to strengthen them against any future shocks.

One of the favorite bets in the market right now is short the U.S. dollar. But could the greenback be in for a turn higher?

The case against the dollar is strong and widely held. Last week, the Commodity Futures Trading Commission's weekly report of currency positions showed that almost all speculators were short the dollar and long the yen, euro, pound, Swiss franc and other currencies.

INSATIABLE Chinese demand has sent the prices of commodities such as iron ore and copper to historic highs; now the Middle Kingdom is helping to drive the gold price ever higher as local investors look for a hedge against soaring inflation and the rising risks to the global economy.

China is the largest gold producer but requires so much of the precious metal (in addition to what it already mines) that it imported more than 209 tonnes during the first 10 months of last year. This represents a five-fold increase from the estimated tonnes it imported in all of 2009.

Setbacks mounted Wednesday in the crisis over Japan's tsunami-damaged nuclear facility, with nearby seawater testing at its highest radiation levels yet and the president of the plant operator checking into a hospital with hypertension.

Nearly three weeks after a March 11 earthquake and tsunami slammed and engulfed the Fukushima Dai-ichi plant, knocking out cooling systems that keeps nuclear fuel rods from overheating, Tokyo Electric Power Co. is still struggling to bring the facility in northeastern Japan under control.

The country's revered Emperor Akihito and Empress Michiko reached out to some of the thousands displaced by the twin disasters — which have killed more than 11,000 people — spending about an hour consoling a group of evacuees at a Tokyo center.

"I couldn't talk with them very well because I was nervous, but I felt that they were really concerned about us," said Kenji Ukito, an evacuee from a region near the plant. "I was very grateful."

Gather 'round, gold standard enthusiasts.

There is a new law in the state of Utah that might be of interest.

The Beehive State has a new measure on the books that eliminates state taxes on the exchange of gold and silver coins and directs the legislature to study an "alternative form of legal tender."

The law, signed by Gov. Gary Herbert last week, also recognizes gold and silver coins issued by the federal government as legal tender in the state.

Of course, they already are. But people use them as investments, not pocket change.

The big legal change in Utah is that the state tax code now treats gold and silver coins -- issued by the U.S. Mint -- as currency rather than an asset. That means no capital gains or other state taxes will be levied when the coins are exchanged.

Chips are disappearing from bags, candy from boxes and vegetables from cans.

As an expected increase in the cost of raw materials looms for late summer, consumers are beginning to encounter shrinking food packages.

With unemployment still high, companies in recent months have tried to camouflage price increases by selling their products in tiny and tinier packages. So far, the changes are most visible at the grocery store, where shoppers are paying the same amount, but getting less.

For Lisa Stauber, stretching her budget to feed her nine children in Houston often requires careful monitoring at the store. Recently, when she cooked her usual three boxes of pasta for a big family dinner, she was surprised by a smaller yield, and she began to suspect something was up.

WASHINGTON (Reuters) - U.S. lenders would have to offer mortgages with at least a 20 percent down payment if they want to repackage the loan to sell to other investors without keeping some of the risk on their books, according to a proposal U.S. bank regulators endorsed on Tuesday.

The Federal Deposit Insurance Corp board agreed to seek public comment on the proposal that is intended to restore lending discipline and define the safest form of mortgages that can be sold to investors.

Last year's Dodd-Frank financial law requires firms that package loans into securities -- a practice known as securitization -- to keep at least 5 percent of the credit risk on their books.

Home prices are falling in most major U.S. cities, and the average prices in four of them are at their lowest point in 11 years. Analysts expect further prices declines in most cities in the coming months.

The Standard & Poor's/Case-Shiller 20-city index released Tuesday shows price declines in 19 cities from December to January. Eleven of them are at their lowest level since the housing bust, in 2006 and 2007. The index fell for the sixth straight month.

Home values in Atlanta, Las Vegas, Detroit and Cleveland are now below January 2000 levels.

Dear Jim:

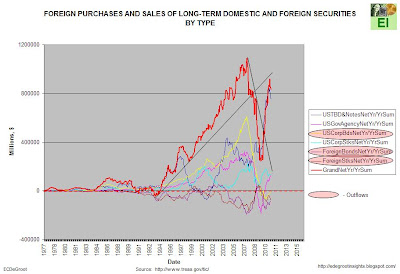

Why you should be confident about your gold holdings. I doubt you will see this chart in the mainstream media any time soon, if EVER.

CIGA Ed P.

Warren Buffett, the billionaire who urged Congress in 2009 to guard against inflation, said investors should avoid long-term fixed-income bets in U.S. dollars because the currency’s purchasing power will decline. “I would recommend against buying long-term fixed-dollar investments,” Buffett, chairman and chief executive officer of Berkshire Hathaway Inc. (BRK/A), said today in New Delhi. “If you ask me if the U.S. dollar is going to hold its purchasing power fully at the level of 2011, 5 years, 10 years or 20 years from now, I would tell you it will not.”

BNY Mellon's Chief Investment Officer Leo Grohowski dropped by "Breakout" Monday to discuss how investors can put their money to work safely in a "see no evil, hear no evil market." Noting that the CBOE volatility index, or VIX, is well below 20 and its 5-year average, Grohowski sees long-term options straddles as one possibility for long-term investors. Grohowski is somewhat skeptical regarding the recent torrid gains in gold, believing the favorite currency of 19th century cowboys and druids of old has gotten ahead of itself relative to commodity metals. Gold spikes tend to unwind in a hurry, leading the CIO to advise investors to use some caution in the yellow metal.

"This budget makes tough choices, which is what you sent me to Albany to do," Cuomo said in a statement. "It closes a $10 billion deficit with no new taxes or borrowing, redesigns government to force it to cut waste and inefficiency and finally delivers real results for hard-working families across New York state."

Cuomo outlined a series of spending cuts, including a $170 million budget reduction for the Office of Court Administration as well as 10% reductions in the budgets of the executive branch, and the offices of the Attorney General and the Comptroller. There were also $54 million in other miscellaneous cuts, he said.

"Government had to tighten its belt with the same sense of urgency that working families have been tightening their belts since the economy went into freefall in 2008," said Assembly Speaker Sheldon Silver.

Meanwhile, US inventories of corn for 2010-11 are currently expected to be at a 15-year low of 17.1m tons, China’s corn consumption is powered by its affluent middle class whose dietary habits have shifted to meat-based food items thereby driving up livestock feed demand.

A Massachusetts employment organization has canceled its annual job fair because not enough companies have come forward to offer jobs. Richard Shafer, chairman of the Taunton Employment Task Force, says 20 to 25 employers are needed for the fair scheduled for April 6, but just 10 tables had been reserved. One table was reserved by a nonprofit that offers human services to job seekers, and three by temporary employment agencies.Source: usatoday.com

The billions of dollars in yen sold by the world’s most powerful central banks have sent a strong message to speculative investors. Those daring to bet that the Japanese currency will again test Y76.25, the record high against the dollar it hit last week before the G7’s intervention, better have deep pockets.Source: ft.com

Orders for U.S. durable goods in February posted the biggest drop in four months, falling 0.9% largely because of lower sales of machinery and defense-related products. Orders minutes the volatile transportation sector also fell, down 0.6%, the Commerce Department reported Thursday. Economists surveyed by MarketWatch has expected orders to rise 1.5% overall, or an even stronger 2.5% minus transportation. Orders for January, meanwhile, were revised up to a 3.6% increase. The government originally reported that total orders rose 3.2% in January.

The average American family's household net worth declined 23% between 2007 and 2009, the Federal Reserve said Thursday.

A rare survey of U.S. households, first performed in 2007 but repeated in 2009 in order to gauge the effects of the recession, reveals the median net worth of households fell from $125,000 in 2007 to $96,000 in 2009.

It is widely known that the 2008 financial crisis resulted in the vaporization of trillions of dollars in household wealth. But Federal Reserve officials said Thursday the new report offers a look at exactly how hard the recession hit families, and how they reacted.

The numbers paint a stark picture.

Families that owned stock saw their portfolios drop by more than a third to $12,000 from $18,500, on average. The value of primary real estate holdings decreased by an average of $18,700.

"The situation today at the Fukushima Dai-ichi power plant is still very grave and serious. We must remain vigilant," a somber Prime Minister Naoto Kan said. "We are not in a position where we can be optimistic. We must treat every development with the utmost care."

The possible breach in the plant's Unit 3 might be a crack or a hole in the stainless steel chamber of the reactor core or in the spent fuel pool that's lined with several feet of reinforced concrete. The temperature and pressure inside the core, which holds the fuel rods, remained stable and was far lower than what would further melt the core.

Put volume for an exchange-traded fund tracking the U.S. dollar against six other major currencies surged to a record after a single trade with a strike price 3.4 percent below today’s close.

An investor bought 94,039 June $21 puts to sell the PowerShares DB US Dollar Index Bullish Fund (UUP) for 16 cents each at 12:28 p.m. in New York, according to a report by Trade Alert LLC, a New York-based provider of options-market data and analytics, and data compiled by Bloomberg.

More than 102,700 puts traded today, a record. The June $21 puts were the most traded and accounted for almost all put trades. The ETF, which began trading in February 2007, declined 0.2 percent to $21.73. It has never closed below $21.65.

My question to this article is WHY?

Why in the world, if you believe that the gold price can go to $5000 and $12,500, as the article says, do you give a flipping damn about the next 90 days.

You must realize that the economic and political damage is already done.

You must realize that the mountain of OTC derivative paper is not going away.

You must realize that all the old Legacy asset, (broken OTC derivatives) demand to be adjusted at each market turn in order to maintain any sememblence that they are serious contracts.

You must realize that this adjustment means adding on new OTC derivatives.

You must realize that this means the mountain of OTC derivative weapons of mass financial destruction can only grow.

You must realize that it is not if, or not, QE will continue, it is what it already has done to the Western Economies that much higher gold prices will reflect.

You must realize this is not a business problem, but rather a debt problem as it applies to the gold price.

You must realize the monumental change in the Middle East is NOT positive for the West in any manner, shape or form.

You must realize that the change in the Middle East is from some form of government to Chaos.

You must realize that the beneficiaries of Chaos in the Middle East is Iran and Russia.

You must realize that the main product of the establishment of a no fly zone in Libya is to benefit the Rebels.

You must realize that the rebels are an unknown factor in Libya.

You must realize that a second product of the no fly zone is greater hatred in the Middle East for all things West.

You must realize that the Peak Production of Energy is behind us.

You must realize that the production of energy in chaos will be less than under some form of rule.

You must realize that this combination of monumental Middle East change and the Peak Oil means Peak oil is no longer a consideration for 10 to 15 years from now, rather it is now.

You must realize that the Angels, gold prices, are not simple talk but rather a method used by the great market mavin Jesse Livermore.

You must realize that on the next trip to $1444, that price will FALL to the long term bull market on gold.

You must realize that $1650, a place where gold will trade is so low as to be comical looking back from 2015.

You must realize that "QE to Infinity" is not a choice but all there is the left in the tool box of US Fed.

You must realize the truth of today's comment by Dallas Federal Reserve Bank President is true.

You must realize that what the President of the Federal Reserve Bank fear will occur.

You must realize no sovereign country needs to go broke.

You must realize they simply refer to QE as policy.

You must realize that it is the currency that breaks, not the country.

You must realize that the point of correctness in the article How & When that is true is his $5000 to $12,500 and not prognostications of the next 90 days.

Jim

Best Buy is changing its TV-selling strategy by significantly increasing TV selection online -- offering 100 models in stores but 300 more online only at more competitive prices.

The chain is also pushing hard to open smaller stores. The company is opening 150 smaller-format mobile only stores by the end of the year, nearly doubling its total to 325.

"We are exploring and redefining what the optimal big-box footprint is for us," CEO Brian Dunn said on a call with analysts.

The US ranks near the bottom of developed global economies in terms of financial stability and will stay there unless it addresses its burgeoning debt problems, a new study has found.

In the Sovereign Fiscal Responsibility Index, the Comeback America Initiative ranked 34 countries according to their ability to meet their financial challenges, and the US finished 28th, said David Walker, head of the organization and former US comptroller general.

Warren Buffett told CNBC Thursday that the collapse of the euro zone's single currency is far from "unthinkable."

"I know some people think it's unthinkable...I don't think it's unthinkable," Buffett said in an interview.

Still, Buffett said he believes there will be "huge efforts" put forth to preserve the euro. In the meantime, struggling peripheral countries like Portugal must find a way to resolve fiscal crises.

"You can't have three or four or five countries that are in effect free-riding on the other countries. That won't work over time-they have to get their fiscal houses in reasonable harmony," he said.

Chinese consumption of gold may climb to rival that of India, the top user, as investors buy the metal as a store of value, said GFMS Ltd. and INTL FCStone.

Demand in China, the world’s second-biggest economy, almost tripled to 580 metric tons last year from 206 tons in 2001, data from the producer-funded World Gold Council show. Use in India may slump 5 percent to 26 percent this year from 963 tons in 2010, Morgan Stanley said in a report yesterday.

Bullion soared to a record $1,444.95 an ounce on March 7 and rallied 30 percent last year for a 10th annual gain as investors sought to preserve their wealth against inflation, Middle East unrest and currency debasement. Consumer prices in China climbed 4.9 percent in February from a year ago, exceeding the government’s 4 percent goal for the full year.

Richard Fisher, who heads the Dallas branch of the Fed, said that the world's biggest economy is no longer in need of further stimulus and the real question is when to begin tightening monetary policy. To embark on a third round of quantitative easing (QE) would "only prolong the injustice inflicted" on savers through inflation, Mr Fisher said.

The Fed started a second, $600bn (367bn pounds) round of QE in November in an effort to ward off the threat of deflation and ignite a recovery that has made little dent in unemployment. The move sparked criticism outside the US that it would fuel inflation, while domestic opponents argued it threatened to debase the dollar.

The price of gold may hit $5,000 per ounce, nearly three times current levels, in three to four years, as demand from sovereign states, central banks and exchange-traded funds (ETFs) rises, the chairman of two Canadian gold mining companies said.

"Gold is used as insurance for bad governments," Rob McEwen, chairman and chief executive of Minera Andes Inc (MAI.TO) and US Gold Corp (UXG.TO), told Reuters on the sidelines of the Mines and Money conference in Hong Kong on Wednesday.

The wisest and most successful bond investor of all time, Bill Gross, has dumped his bond fund’s $150 billion investment in U.S. bonds. One should not ignore the importance of this event. The largest bond fund in America no longer believes that Treasury bonds are a good investment. Moreover, Gross is not alone. Blackrock, the world’s largest money manager, is now underweighting Treasuries overall and reducing the duration of the bonds it still holds. That means they are dumping their long-term bonds, which are the most sensitive to interest-rate changes, in favor of Treasury instruments that mature in a year or less. Other bond funds, such as the $20 billion Loomis Sayles funds, are also forgoing Treasuries in favor of high-yield corporate bonds. Virtually everywhere you look, from great investors such as Warren Buffett to insurance companies such as Allstate, everyone is dumping their long-term U.S. debt and either buying debt that matures in less than a year or moving their money elsewhere.

So who is still buying U.S. debt? According to Bill Gross, the “old reliables” — China, Japan, and OPEC — are still in the market for 30 percent of all new debt. The rest, however, is being purchased by the Federal Reserve. There is no one in else in the market. For the first time ever, Americans are refusing to purchase their own country’s debt.

Yemen's U.S.-backed president, his support crumbling among political allies and the army, warned that the country could slide into a "bloody" civil war Tuesday as the opposition rejected his offer to step down by the end of the year. Tens of thousands protested in the capital demanding his immediate ouster, emboldened by top military commanders who joined their cause.

Ali Abdullah Saleh's apparent determination to cling to power raised fears that Yemen could be pushed into even greater instability. In a potentially explosive split, rival factions of the military have deployed tanks in the capital Sanaa — with units commanded by Saleh's son protecting the president's palace, and units loyal to a top dissident commander protecting the protesters.

The missile strikes that inaugurated America's latest attempt at regime change were launched 29 days before the 50th anniversary of another such -- the Bay of Pigs of April 17, 1961. Then, the hubris of US planners was proportional to their ignorance of everything relevant, from Cuban sentiment to Cuba's geography. The fiasco was a singularly feckless investment of US power.

Does practice make perfect? In today's episode, America has intervened in a civil war in a tribal society, the dynamics of which America does not understand. And America is supporting one faction, the nature of which it does not know.

China's holding's of US debt fell for the third month in January, while buying from Japan and Britain picked up, the Treasury Department said Tuesday.

Chinese holdings of Treasury securities fell $5.4 billion, or less than half a percent, to $1.15 trillion in January from December.

January's level was $20.6 billion lower than the peak of $1.175 trillion in October.

China's holdings are keenly watched as a sharp turn away from US bonds by their biggest foreign buyer could send US debt costs skyrocketing.

Moreover, leaked diplomatic cables in February vividly showed China's willingness to translate its massive holdings of US debt into political influence on issues ranging from Taiwan's sovereignty to Washington's financial policy.

The products, secured by state-backed mortgage giants Fannie Mae and Freddie Mac, were bought as part of the 2008-2009 financial sector bailout.

As the housing bubble began to burst the Treasury and Federal Reserve bought up swathes of so-called "toxic assets," when losses appeared to be endangering individual banks and the financial system at large.

But the Treasury said the market for asset-backed derivatives is now much more robust, three years after the depths of the crisis.

At the height of the housing bubble, hedge-fund manager Paul Singer was shorting subprime mortgages. By the spring of 2007, he was warning regulators on both sides of the Atlantic that the world was facing a major financial crisis.

They ignored him. Now the founder of Elliott Management says the biggest banks are headed for another credit meltdown. Among the likely triggers for the next crisis, Mr. Singer sees one leading candidate: Monetary policy "is extremely risky," he says, "the risk being massive inflation."

In some areas gas prices have reached $4 per gallon, and now Americans must brace themselves for higher grocery bills. This week the Labor Department reported that February wholesale food prices posted their sharpest increase since 1974. News like that has driven Mr. Singer to the history books: He treats visitors to his 5th Avenue office to a copy of a 1931 treatise on German currency debasement, Constantino Bresciani-Turroni's "The Economics of Inflation."

Just as Portugal appeared to have dodged a bailout like those taken by Greece and Ireland, a domestic political spat was set Monday to worsen its financial troubles and possibly spoil Europe's efforts to put the sovereign debt crisis behind it.

Portugal's main opposition parties told the beleaguered minority government they won't budge from their refusal to endorse a new set of austerity measures designed to ease a huge debt burden that is crippling the economy.

Iran has bought large amounts of gold in the international market, according to a senior Bank of England official, in a sign of how growing political pressure has driven Tehran to reduce its exposure to the US dollar.

Andrew Bailey, head of banking at the Bank of England, told an American official that the central bank had observed “significant moves by Iran to purchase gold”, according to a US diplomatic cable obtained by WikiLeaks and seen by the Financial Times.

The U.S. economy faces numerous obstacles that threaten to derail the recovery. But economists are most fearful of one major headwind: oil prices.

More than two-thirds of the 23 economists surveyed by CNNMoney identified high oil prices as the most serious risk facing the economy.

As uprisings spread across the Middle East and North Africa, prices have soared about 15% in the past two months, pushing gas prices higher. And as the situation in Libya escalates, economists are growing more jittery about oil prices, even in the face of other threats to the economy, like the crisis in Japan, cuts in government spending and continued weakness in the housing sector.

Libya's government has begun distributing arms to more than one million people and will complete the operation within hours, the state news agency reported on Sunday.

Jana news agency quoted sources in Libya's defence ministry as saying they "expected the operation to end in the next hours to arm more than a million men and women."

It's not always easy to feel sorry for sunny Florida. But they just got hit with another blow.

On Thursday, the Census Bureau revealed that 18% -- or 1.6 million -- of the Sunshine State's homes are sitting vacant. That's a rise of more than 63% over the past 10 years.

Having this amount of oversupply on the market will keep home prices depressed and slow any recovery.

During the housing boom, Florida was among the hottest real estate markets in the nation. Homes were snapped up by the state's growing population as well as hordes of investors confident that prices would continue to soar.

As workers scrambled to curb a nuclear crisis Saturday, the Japanese government is looking into halting the sale of food from farms near Fukushima plant after abnormally high levels of radiation were found in milk and spinach.

Very small amounts -- far below a level of concern -- of radioactive iodine were also detected in tap water in Tokyo and most prefectures near the Fukushima Daiichi plant damaged by last week's monster earthquake and tsunami.

Six members of the emergency crew at the plant have been exposed to more than 100 millisieverts of radiation per hour, the equivalent of getting 10 chest x-rays per hour, plant owner Tokyo Electric Power Company said.

China tried to quell panic buying of iodized salt Thursday after grocery stores across the country were emptied of the seasoning by hordes of people hoping to ward off radiation poisoning after the nuclear accidents in Japan.

The clamor for salt reportedly started after rumors spread, possibly by cellphone text messaging, that China would be hit by a radioactive cloud from Japan's Fukushima No. 1 (Daiichi) nuclear plant, which had been badly damaged during last week's earthquake and tsunami.

The value of a college education has been a hot topic of discussion here at Tech Ticker. Now there’s more fodder for debate.Source: finance.yahoo.com

A new study from Princeton University shows that expensive college degrees are not necessarily worth the lofty price tags in the long run when you take into account one's natural ability.

Laurence Kotlikoff, professor of economics at Boston University agrees that an expensive education just isn't worth it -- much to his chagrin of course because tuition and fees at Boston University totalled $39,314 for 2010-11.

With unemployment still about 9 percent, on average, for college graduates under the age of 25, and total student-loan debt now topping that of credit card debt in this country, he tells Aaron in the accompanying clip, “If you think of education as solely a monetary investment, if we are not thinking about all the other benefits from education like learning things, and getting to hang out with me, and also just becoming a more cultured person, then we have to look at this very carefully.”

The US Federal Reserve may have no choice but to introduce a third round of quantitative easing, or QE3, in light of the significant headwinds facing the global economy as well as problems at home, Stephen Pope, Managing Partner at Spotlight Ideas said.

“The plight of several US states is becoming serious,” he said.

“California is not likely to reduce the double digit level of unemployment it currently endures and the “Golden State” is said to carry a budget deficit of $25 billion by the end of the second quarter of 2012. State pension programs are pushing the state close to the brink and yet the administration of Governor Jerry Brown appears, bar a state hiring freeze, to do nothing to address the issue,” he said.

Yemeni government snipers firing from rooftops and houses shot into a crowd of tens of thousands of anti-government demonstrators on Friday, killing at least 40 people and injuring hundreds demanding the ouster of the autocratic president.

The protest in the central square was the largest yet in the popular uprising that began a month ago — and the harsh government response marked a new level of brutality from the security forces of President Ali Abdullah Saleh, a key — if uneasy — ally in the U.S. campaign against al-Qaida who has ruled Yemen for 30 years.

Asian markets posted gains and European shares were headed higher Friday as the yen retreated from historic highs after the world's seven leading industrial nations pledged to rein in the currency to help earthquake-stricken Japan.

The benchmark Nikkei 225 in Tokyo rose 2.7 percent to close at 9,206.75, capping a turbulent week that saw stocks lose 16 percent over Monday and Tuesday. Those were the first two trading days after Japan was struck by a mammoth earthquake and tsunami on March 11 that wiped out much of its industrial northeast and severely damaged a nuclear power plant that continues to leak low levels of radiation.

The Bahrain proxy conflict and the actual conflict continue after yesterday's shocking violence.

Iranian lawmaker Hossein Naqavi tells Press TV: “The Saudi's should know for a fact that Tehran will use all the power and potentials at its disposal to halt the oppression of the people of Bahrain.”

Stocks are opening higher, a day after suffering their worst losses in seven months.

Before the market opened Thursday, the government said first-time applications for unemployment benefits dropped last week. Claims fell to 385,000, a slightly bigger fall than economists had expected.

A separate report showed consumer prices edged higher in February. The Consumer Price Index rose 0.5 percent last month, slightly stronger than forecasts.

Japan's central bank sprayed more cash over jittery money markets Thursday as a major bank's ATMs suffered a two and a half hour outage nationwide and the yen shot to a record high.

The Bank of Japan injected an additional 6 trillion yen ($76.7 billion) in same-day funds after the dollar hit 76.25 yen in the morning -- an all-time low for the greenback in the aftermath of Friday's earthquake and tsunami that killed thousands and triggered an unfolding nuclear crisis. With same-day funds, banks in need can access cash immediately.

Treasury Secretary Timothy Geithner said on Wednesday that there was no alternative except for Congress to raise the debt ceiling so that the government can keep borrowing.

"Congress has to do it. There's no alternative," he said in response to questions at a House of Representatives appropriations subcommittee.

He repeated a warning that it would be have "catastrophic" consequences for the economy if the debt ceiling was not raised and the country defaulted on its debt obligations.

The top U.S. nuclear regulator warned on Wednesday that one pool holding spent fuel at Japan's stricken nuclear plant may have run dry and a second could be leaking, something experts say could accelerate the release of radiation.

"We believe at this point that Unit Four may have lost a significant inventory, if not lost all, of its water," Gregory Jaczko, head of the U.S. Nuclear Regulatory Commission, told lawmakers at a House energy and commerce subcommittee hearing.

Officials in Japan have not said how much water remains in the pool.

DANGEROUS POOLS

The pools are dangerous for two reasons: being outside a containment wall protecting the nuclear core, they are more easily exposed to the atmosphere; and the building housing the No. 4 reactor's pool has suffered hydrogen gas explosions.

They also hold radioactive elements that could quickly heat up again if water burns off. Experts worry that this could expose the used nuclear fuel and start a fire that would release more radioactivity.

"There is no water in the spent fuel pool and we believe that radiation levels are extremely high, which could possibly impact the ability to take corrective measures," said Jaczko, making his first appearance before Congress since the crisis began.

Protesters demand release of Sheikh Ali Salman, a Shi'ite Moslem cleric arrested after distributing leaflets calling for restoring parliament dissolved in 1975.

January 1995 - Bahrain deports Sheikh Salman and two other clergymen.

April 1995 - Three Shi'ite Moslem clergymen are arrested including the influential Sheikh Abdul-Amir al-Jamri, triggering clashes with police that residents said led to at least one man being killed and 16 injured.