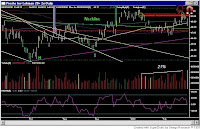

As long as upside energy continues to increase, the dark glove has two options in the bond market. Either lay down more paper to protect critical support (neckline of large head and shoulders formation), increase the number of cannons on the battlefield, or execute a defensive retreat to fight at a lower price.

These options sounds quite familiar to those that follow the money flows in the gold market. As it should. The bond, dollar, gold markets are intertwined.

US Long Bonds Double Inverse ETF (TBT)

0 comments:

Post a Comment