The market, regardless of the actions of central planners, has been and will always be in charge. This painful lesson from history, unfortunately, is rediscovered within a backdrop of finger pointing and astonishment roughly every hundred years. Today, is yet another cycle of rediscovery by a public far too distanced from the lessons of history.

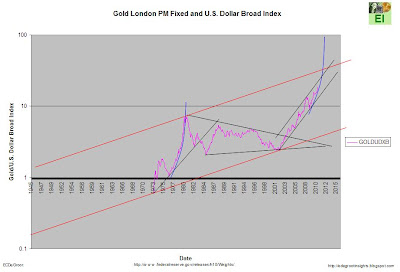

The market, regardless of the actions of central planners, has been and will always be in charge. This painful lesson from history, unfortunately, is rediscovered within a backdrop of finger pointing and astonishment roughly every hundred years. Today, is yet another cycle of rediscovery by a public far too distanced from the lessons of history.Central planning always chooses the path of least resistance even if it means shooting itself in the foot (against market forces) in the process. The larger economies of the West, despite the suggestions otherwise, follow this axiom. While their on going default through currency devaluation is often disguised by friendly headlines and economic spin today, it is no different in terms of consequences. Currency devaluation, the path of least resistance, is not a policy choice limited to smaller economics such as Venezuela. The following chart illustrates the devaluation of fiat (paper money) relative gold as measured by all global currencies.

Approve or disapprove, recognized or not, the hammer of change has already dropped.

Gold London PM Fixed and U.S. Dollar Broad Index:

Source: edegrootinsights.blogspot.com

Headline: Venezuela Devalues Bolivar For Imported `Essential Goods,' Unifying Rates

Venezuela devalued its currency for the second time since January, enabling the government to increase revenue at the risk of pushing up the world's highest inflation rate.

The government will weaken the exchange rate on so-called essential goods such as food and medicine by 40 percent to 4.3 bolivars per dollar on Jan. 1, unifying its two fixed foreign exchange rates in bid to pull the economy out of recession, Finance Minister Jorge Giordani said today on state television. Imports of essential goods were previously bought at a rate of 2.6 bolivars per dollar.

Source: bloomberg.com

0 comments:

Post a Comment