I have read recently that solid bottoms in gold tend to be associated with commercial traders are aggressively buying rather than just covering short positions. What's your take?

Thank you,

Ron

Hello Ron,

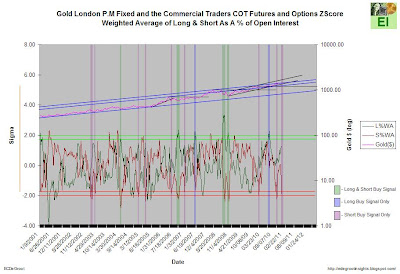

My take is that there are no absolutes in precious metals markets. “Strong bottoms,” and I use that term loosely, tend to be associated with not only aggressive short covering but also buying by connected money. The chart below parses commercial futures and options into long and short money flows. The green shaded boxes represent the presence of both aggressive short covering and buying by commercial traders. That is, the perfect storm of money flowing into paper gold. A cursory examination of the chart, however, reveals that green shaded boxes failed “paint” every buying opportunity. Definable bottom, which could also be characterized as strong, have occurred during periods of aggressive short covering without buying en mass. These bottoms are shaded purple. In addition, definable bottoms have been created during periods of aggressive buying without much short covering. These bottoms are shaded blue.

Gold London P.M Fixed and the Commercial Traders COT Futures and Options ZScore Weighted Average of Long & Short As A % of Open Interest:

The study of money flows in precious metals requires detailed analysis of long, short, and net long positions within the context of cycles. As yesterday’s commentary and analysis suggested, the net long transfer which has yet to include further selling after 1/18 is already the fourth strongest since 2001. This implies a powerful redistribution (transfer from weak to strong hands) is already underway. This powerful redistribution will setup the next leg up. Perhaps the 1/25 data will illustrate the development of another perfect storm in money flows. That is, the presence of both aggressive short covering and buying by connected players as cycle dates approach.

0 comments:

Post a Comment