Just like in the 70s when gold began its historic climb, the final Pillar of Gold (a bear market in US Treasuries) must be in to attain $1650 and above.

US Treasuries breaking down, as they are with the 25 years plus up trend to be decimated must happen.

Then you can make living selling US Treasuries rallies short for many years to come.

In the 70s rates on ten year bonds went from under 4% to 14 7/8%.

In the 70s overnight money went above 21%

It will happen again as gold climb to and through $1650.

The formula of 2006 clearly points out that this MUST happen.

It was simply common sense as gold is now at $1650 and better.

There is another salient point that not only is the Health Bill the biggest grab of centralized power since Roosevelt, it was desired by only 37% of the population while 48% did not want it in that form or at all.

Confidence is what makes currency value and that is sundering fast.

The US dollar is no safe haven.

Jim

The yield on 10-year Treasuries – the benchmark price of global capital – surged 30 basis points in just two days last week to over 3.9pc, the highest level since the Lehman crisis. Alan Greenspan, ex-head of the US Federal Reserve, said the abrupt move may be "the canary in the coal mine", a warning to Washington that it can no longer borrow with impunity. He said there is a "huge overhang of federal debt, which we have never seen before".

Frankly, the canary in the coal mine died a long time ago. What we are seeing now is recognition of the problem. Recognition has the potential to produce acceleration within the existing trends.

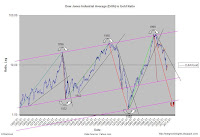

Long-Term U.S. Government Bonds Total Return Index (LTGBTRI) to Gold Ratio:

Long-Term U.S. Government Bonds Total Return Index (LTGBTRI):

Source:

telegraph.co.uk