“Today we’ll see quiet defensive trading ahead of the FOMC meeting,” said Jason Rogan, director of U.S. government trading at Guggenheim Partners LLC, a New York-based brokerage for institutional investors. “The market fully expects the Fed to reiterate low rates for longer. We may see a bit of concession leading up to the auction.”

If an unstoppable force meets an immovable object, what happens?

The U.S. bond market is created.

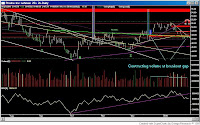

The defense of critical support, dubbed the push of the invisible hand, has been successful. The technical picture, however, suggests that while a battle may have been won the war still rages. TBT (2x inverse long bonds) shows contracting volume while maintaining both gap and neckline support. As long as this persists, it suggests waning downside force.

That which cannot break support with force will eventually reverse and attempt to break resistance with force.

Long Bonds 2x Inverse ETF (TBT):

Positive money flows from strong hands have not retreated despite the negative technical setup. Traders normally swarm for the kill when they sense blood in the water. We don't see this in the bond market. The battle between illusion (immovable object) and economic reality (unstoppable force) in the bond market is no trivial matter. The resolution of this war in terms of interest rates will have broad economic consequences. Consequences that would be deemed a threat to our national interests.

Source: bloomberg.com

0 comments:

Post a Comment