On Friday we found out the the supply on the Comex and hammering of gold was primarily the product of an undisciplined hedge fund trader who got caught in an outrageously large spread under-financed. We also learned of the problem in Egypt that few thought as serious as it has become. Gold had two drivers Friday. The clear fact that the supply in gold was an aberration that drew the chart. Yes, Egypt but not fully appreciated. Egypt is "Iran and the Shah revisited." That is extremely SERIOUS.

Jim

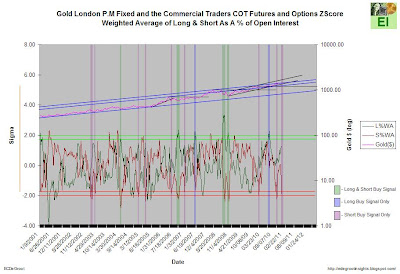

Spreading activity and open interest have collapsed. This tends to reflect the mass exodus of the noncommercial (specs) and nonreportable (retail) traders.

Gold London P.M Fixed And Stochastic Weighted Average of Spreading As A % of Open Interest:

Gold London P.M Fixed and the Commercial Traders COT Futures and Options Stochastic Weighted Average of Net Long As A % of Open Interest:

Headline: Small Gold Trader Makes Big Splash

Thanks to the nature of futures trading, Daniel Shak's $10 million hedge fund held gold contracts valued at more than $850 million, more than 10% of the main U.S. futures market, and the equivalent of South Africa's annual gold production.

But as gold prices started falling this year, the trade, which was a combination of being long and short gold contracts—bets that prices will both rise and fall—started going bad. Monday, he liquidated his position, and is returning money to clients.

As a result, the number of gold contracts on CME Group Inc.'s Comex division plunged more than 81,000, to about 500,000, the biggest single reduction ever. While his trade didn't account for all of the contracts, an average daily move is about 3,000 to 5,000 contracts.

Source:

online.wsj.comHeadline: The Egyptian Unrest: A Special Report

January 29, 2011 2207 GMT

Egyptian President Hosni Mubarak remains the lifeblood of the demonstrators, who still number in the tens of thousands in downtown Cairo and in other major cities, albeit on a lesser scale. After being overwhelmed in the Jan. 28 Day of Rage protests, Egypt’s internal security forces — with the anti-riot paramilitaries of the Central Security Forces (CSF) at the forefront — were glaringly absent from the streets Jan. 29. They were replaced with rows of tanks and armored personnel carriers carrying regular army soldiers. Unlike their CSF counterparts, the demonstrators demanding Mubarak’s exit from the political scene largely welcomed the soldiers. Despite Mubarak’s refusal to step down Jan. 28, the public’s positive perception of the military, seen as the only real gateway to a post-Mubarak Egypt, remained. It is unclear how long this perception will hold, especially as Egyptians are growing frustrated with the rising level of insecurity in the country and the army’s limits in patrolling the streets.

There is more to these demonstrations than meets the eye. The media will focus on the concept of reformers staging a revolution in the name of democracy and human rights. These may well have brought numerous demonstrators into the streets, but revolutions, including this one, are made up of many more actors than the liberal voices on Facebook and Twitter.

After three decades of Mubarak rule, a window of opportunity has opened for various political forces — from the moderate to the extreme — that preferred to keep the spotlight on the liberal face of the demonstrations while they maneuver from behind. As the Iranian Revolution of 1979 taught, the ideology and composition of protesters can wind up having very little to do with the political forces that end up in power. Egypt’s Muslim Brotherhood (MB) understands well the concerns the United States, Israel and others share over a political vacuum in Cairo being filled by Islamists. The MB so far is proceeding cautiously, taking care to help sustain the demonstrations by relying on the MB’s well-established social services to provide food and aid to the protesters. It simultaneously is calling for elections that would politically enable the MB. With Egypt in a state of crisis and the armed forces stepping in to manage that crisis, however, elections are nowhere near assured. What is now in question is what groups like the Muslim Brotherhood and others are considering should they fear that their historic opportunity could be slipping.

One thing that has become clear in the past several hours is a trend that STRATFOR has been following for some time in Egypt, namely, the military’s growing clout in the political affairs of the state. Former air force chief and outgoing civil aviation minister Ahmed Shafiq, who worked under Mubarak’s command in the air force (the most privileged military branch in Egypt), has been appointed prime minister and tasked with forming the new government. Outgoing Intelligence Chief Omar Suleiman, who has long stood by Mubarak, is now vice president, a spot that has been vacant for the past 30 years. Meanwhile, Defense Minister Field Marshal Mohammed Hussein Tantawi (who oversees the Republican Guard) and Egypt’s chief of staff of the armed forces, Lt. Gen. Sami Annan — who returned to Cairo Jan. 29 after a week of intense discussions with senior U.S. officials — are likely managing the political process behind the scenes. More political shuffles are expected, and the military appears willing for now to give Mubarak the time to arrange his political exit. Until Mubarak finally does leave, the unrest in the streets is unlikely to subside, raising the question of just how much more delay from Mubarak the armed forces will tolerate.

The important thing to remember is that the Egyptian military, since the founding of the modern republic in 1952, has been the guarantor of regime stability. Over the past several decades, the military has allowed former military commanders to form civilian institutions to take the lead in matters of political governance but never has relinquished its rights to the state.

Now that the political structure of the state is crumbling, the army must directly shoulder the responsibility of security and contain the unrest on the streets. This will not be easy, especially given the historical animosity between the military and the police in Egypt. For now, the demonstrators view the military as an ally, and therefore (whether consciously or not) are facilitating a de facto military takeover of the state. But one misfire in the demonstrations, and a bloodbath in the streets could quickly foil the military’s plans and give way to a scenario that groups like the MB quickly could exploit. Here again, we question the military’s tolerance for Mubarak as long as he is the source fueling the demonstrations.

Considerable strain is building on the only force within the country that stands between order and chaos as radical forces rise. The standing theory is that the military, as the guarantor of the state, will manage the current crisis. But the military is not a monolithic entity. It cannot shake its history, and thus cannot dismiss the threat of a colonel’s coup in this shaky transition.

The current regime is a continuation of the political order, which was established when midranking officers and commanders under the leadership of Gamal Abdel Nasser, a mere colonel in the armed forces, overthrew the British-backed monarchy in 1952. Islamist sympathizers in the junior ranks of the military assassinated his successor, Anwar Sadat, in 1981, an event that led to Mubarak’s presidency.

The history of the modern Egyptian republic haunts Egypt’s generals today. Though long suppressed, an Islamist strand exists amongst the junior ranks of Egypt’s modern military. The Egyptian military is, after all, a subset of the wider society, where there is a significant cross- section that is religiously conservative and/or Islamist. These elements are not politically active, otherwise those at the top would have purged them.

But there remains a deep-seated fear among the military elite that the historic opening could well include a cabal of colonels looking to address a long-subdued grievance against the state, particularly its foreign policy vis-à-vis the United States and Israel. The midranking officers have the benefit of having the most direct interaction — and thus the strongest links — with their military subordinates, unlike the generals who command and observe from a politically dangerous distance. With enough support behind them, midranking officers could see their superiors as one and the same as Mubarak and his regime, and could use the current state of turmoil to steer Egypt’s future.

Signs of such a coup scenario have not yet surfaced. The army is still a disciplined institution with chain of command, and many likely fear the utter chaos that would ensue should the military establishment rupture. Still, those trying to manage the crisis from the top cannot forget that they are presiding over a country with a strong precedent of junior officers leading successful coups. That precedent becomes all the more worrying when the regime itself is in a state of collapse following three decades of iron-fisted rule.

The United States, Israel and others will thus be doing what they can behind the scenes to shape the new order in Cairo, but they face limitations in trying to preserve a regional stability that has existed since 1978. The fate of Egypt lies in the ability of the military to not only manage the streets and the politicians, but also itself.

Source:

stratfor.com