Year Two

4-Year Cycle Risk Free Total Returns* 1926-2010:

The time to follow ‘connected money’ into the market was July and August 2010. These dates represented ‘easier’ entry points. Will the market rally after the election or sell off depends largely on the commitment of the specs and retail investors to chase strength within the context of a statistically neutral setup (neither overbought or oversold).

S&P 500 and the Commercial Traders COT Futures and Options Equity Diffusion Index (DI):

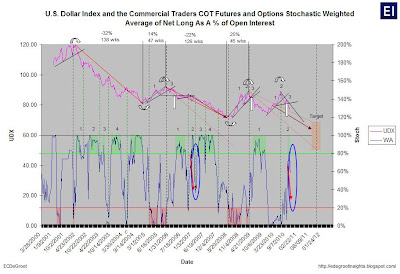

As I wrote above, capital continues to flow into equities as hedge against currency devaluation. Those trying to anticipate a stock market rally must follow the money flow setup in the U.S. dollar. Selling the U.S. dollar rally (as illustrated in the chart below) will foreshadow another decline in the dollar and rally in the equity market.

U.S. Dollar Index and the Commercial Traders COT Futures and Options Stochastic Weighted Average of Net Long As A % of Open Interest:

Democrats and Republicans may both have something to celebrate in the months following the midterm elections: A stock market rally. From 1922 to 2006, the average gain of the Dow Jones Industrial Average over the 90 trading days following midterms (roughly November until mid-March) was 8.5 percent, according to a new study authored by Brian Gendreau, market strategist for Financial Network. That's almost 5 percent higher than the Dow's gains in non-election years.

Source: finance.yahoo.com

0 comments:

Post a Comment