Thanks Eric,

Here are my questions, I'd also like to make a donation to your blog, please let me know who to make the check out to and the address to send, thanks in advance.

1. I've been following G & S for a couple years now. One if my sources of info is GATA & Lemetropole Cafe, run by the well known Bill Murphy(

http://www.lemetropolecafe.com/). It is known that the bullion banks use paper to short the metals and therefore keep the prices suppressed. In an environment where "gold is the enemy", how effective can techinical analysis really be? A good example would be the recent break out, both the metals looked very strong, and were climbing nicely, then all of a sudden we experience another 'takedown' and we wipe of 60 bucks in three days? What are your general thoughts regarding this manipulation, and how effective techincal analysis can be in such an environment.

2. Jim S. has been a wonderful resource for us all. While he does not like to time the market, he has long held the 1650 figure for gold by end of this year, then referring to Armstrong's numbers for the next leg up. With what has happened this last week, and many calling for a correction in gold because of the healthy runup, do you think Jim's number can actually be reached by end of year?

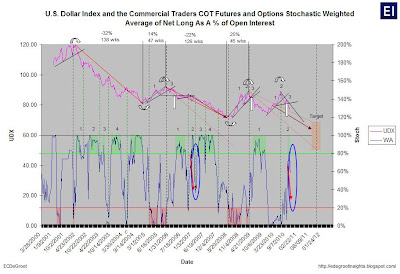

3. In your articles, you oftern talk of connected money positioning itself for the long side. Can you tell me how long you think this positioning will take? In other words, I'm trying to find out when will the 'connected money actually want to stop suppressing the price and let it rise?

4. Lastly, where do I look to find the footprints of connected money? Any resources would be appreciated.

Thanks again Eric, look forward to hearing your thoughts

Amir

My Responses

1. No market or trend - stocks, bonds, currencies, gold, silver, etc can be manipulated long against the secular trend. History is very clear on the subject of control and manipulation. When the message of the market is ignored or misunderstood it gives rise to the common presumption that a misbehaving market must be manipulated. This is not to suggest that key markets, such as gold, are not controlled. At times the control, such as $20/oz or $35/oz fix, is official. Other times, the control is more subtle. Nevertheless, all control that contradicts or fights the secular trend will be smashed by market forces.

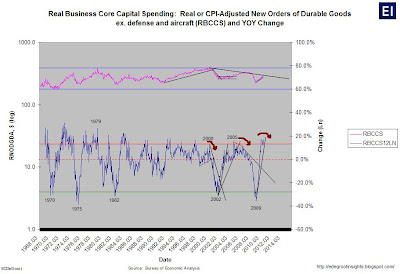

2. Jim’s forecast shows an exceptional understanding of the price cycle. In my opinion, Jim’s point forecast is immaterial for most long-term gold holders. $1650 will be breached, but the focus should not be on time but rather the economic and financial implication of trend acceleration in 2010-2012.

3. Connected money does what they do (right or wrong). Market forces, however, are relentless. As

Lee Iacocca often said in the old Chrysler Ads - "Lead, Follow or Get Out of the Way." In gold terms, either Lead – open embrace the secular trends, Follow – quietly embrace the secular trends with money, or get the hell out of the way. The latter tends to force the issue in capital markets.

4. Footprints of connected money. As I have said many times before. Follow the money. Leveraged markets control price. Following this logic, Follow the money in leverage markets.

Regards,

Eric