Discussion about a market crash always seems to intensify as September and October approach. Many reports and emails suggest a market crash based on a technical reading known as the

Hindenburg Omen. The basis of this technical reading is based on the marginal activity of stock at the "extremes". If the number of stocks generating both new highs and lows is increasing, the market becomes indecisive, or lacks conviction on direction and becomes vulnerable to a decline.

I calculate my own ‘Hindenburg Omen’ based on a few alterations that remove the statistical biases. While the ‘Hindenburg’ or ‘NHLLogic’ based on the observations made by Norm Fosback in Stock Market Logic has preceded major declines, it has given numerous false signals. On balance, the modified indicator has decent track record in illustrating when the market lacks directional conviction. It does not necessarily imply an impending crash.

Where does this indicator stand now?

NHL Logic

The NHL Logic has generated a statistically extreme reading, i.e. an illustration of market indecisiveness. Many experts have interpreted this as a crash signal, but similar signals were generated in 2004 and 2006. Those readings produced no crash.

The study of money flows (capital flows), time, and trend energy provide a better indication of future market direction than any one indicator.

Connected money has faded (bought the decline) in U.S. equities. The higher beta (more sensitive to volatility) technology stocks received statistically significant inflows during the decline from connected money last week.

Nasdaq 100 and the Commercial Traders COT Futures and Options Stochastic Weighted Average of Net Long As A % of Open Interest

The broad inflows into equities during the decline can be revealed in the following chart:

Money Flow Upper Table

Broad inflows into stocks as a minor cycle date, TIME, approaches suggest a market setting up against

consensus expectations of a decline for an advance driven by the secular trend of fiat devaluation.

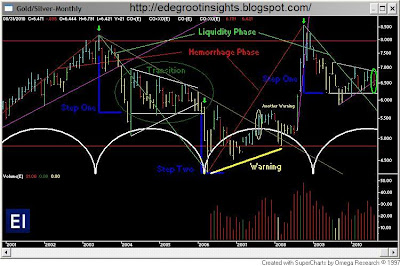

While the media focuses solely on the stock and bond market, they avert attention away from the bullish action and potential in gold, silver, and precious metals stocks.

Year Two

4-Year Cycle Risk Free Total Returns* 1926-2010:

Supportive inflows into equities, despite the F-TV blackout on the sector, will complete the breakout in the precious metals stocks in the fall of 2010.

S&P Gold (Formerly Precious Metals Mining)*

*S&P Gold from 1945, Barron's Gold Stock Index from 1939-1945, 1922-1939 Homestake Mining