With the two giant nations joined at the hip economically, Sino-U.S. tensions are unlikely to escalate into outright confrontation, but could make cooperating on global economic and security issues all the more difficult.

Source: reuters.com

With the two giant nations joined at the hip economically, Sino-U.S. tensions are unlikely to escalate into outright confrontation, but could make cooperating on global economic and security issues all the more difficult.

Hi Eric,

I enjoy reading your posts on mineset. I must admit that sometimes you are over my head though.

I have been a PM buy and hold guy for 3 years now without trading back into cash on any occasion. I have a feeling that PM stocks and physical silver are about to take an ass kicking for the next 9-18 months.

Hello Jack,

You must understand why you are holding gold. Without understand of why, it is too easy to let fear dominate decision making.

If you fear gold in 2010, it is because the dollar will rise. If the dollar is ready to rise in 2010, does the money, not the talk, anticipate such an event? Is the fear of holding gold stocks a function of an anticipated decline in gold or equities? History suggests that gold stocks, though having the tendency to follow equities over the short-term, take their lead from gold. In other words, the correlation between gold stocks and gold is much stronger than that between gold stocks and equities since 1925. Indeed, a severe, capitulation-style decline in equities would likely pull down the gold stocks. A third capitulation decline within a depression, which in and of itself has no historical precedent, occurring within a year of the termination of the previous in 2009.03 would be unique.

This does not suggest equities are solid or even the place to be. As long as this infinite QE, devaluation-as-the-path-to-prosperity mess continues to churn, few sound choices exist beyond gold.

Regards,

Eric

These changes are optical rather than substantive. Given the spending agenda that is already in place, we can expect to see large increases in the proportion of GDP that is spent by our government for years to come.

Of course the proposal is going to be optical. Nearly all of last quarter's marginal GDP, quater over quarter change, came from personal consumption expenditures (PCE) and governement consumption expenditures and investment (GCEI). A spending freeze would take a serious bite out of GDP as we approach the critical mid-term elections. If that doesn't matter they might as well shoot for total political annialation and raise taxes.

Source: online.wsj.com

The battle between illusion (immovable object) and economic reality (unstoppable force) in the bond market is no trivial matter. The resolution of this war in terms of interest rates will have broad economic consequences. Consequences that would be deemed a threat to our national interests. The inflows by strong hands at support, spot-shadowed, illustrates the importance of the technical picture.

The war rages in the bond market.

In previous commentary, I also wrote "Beat the grass to startle the snakes." In other words, wait and see how retail money gets played. As in most markets, they didn't stand a chance.

US TBd (20 Years +) and the Commercial Traders COT Futures and Options Stochastic Weighted Average of Net Long As A % of Open Interest:

US TBd (20 Years +) and the Nonreportable Traders COT Futures and Options Stochastic Weighted Average of Net Long As A % of Open Interest:

Source: The immovable object meets an unstoppable force

A great industrial nation is controlled by its system of credit. Our system of credit is concentrated. The growth of the Nation and all our activities are in the hands of a few men. We have come to be one of the worst ruled, one of the most completely controlled and dominated Governments in the world - no longer a Government of free opinion no longer a Government by conviction and vote of the majority, but a Government by the opinion and duress of small groups of dominant men....

Since I entered politics, I have chiefly had men's views confided to me privately. Some of the biggest men in the U.S., in the field of commerce and manufacturing, are afraid of somebody, are afraid of something. They know that there is a power somewhere so organized, so subtle, so watchful, so interlocked, so complete, so pervasive, that they had better not speak above their breath when they speak in condemnation of it.

Woodrow Wilson - In The New Freedom (1913)

Bear in mind that Wilson signed the Federal Reserve Act of 1913.

Source: quotes

The yen weakened against its 16 most-traded counterparts after Bank of Japan Governor Masaaki Shirakawa said he’s ready to act to ensure “market stability.”

It slipped 1.3 percent to 48.6930 against the real and was 1 percent weaker against the rand at 11.9594, after Shirakawa said at a conference in Tokyo that the Bank of Japan is prepared “to act swiftly and decisively should concerns re- emerge that financial market stability might be hampered.”

In comments delivered on the fringe of the World Economic Forum, Mr Soros said: "When interest rates are low we have conditions for asset bubbles to develop, and they are developing at the moment. The ultimate asset bubble is gold."

Quick glance at long-term historical patterns:

Source: telegraph.co.uk

Source: bloomberg.com

Definition: beggar thy neighbor polices

Beijing Songshanheli Mining Investment Co. Ltd, a private Chinese mining company, is pleased to announce the signing of a joint venture agreement with Jinchuan Mining (JNMC) for a strategically located group of prospecting licenses in northwestern Tanzania.

Chinese joint ventures not only shore up the resources necessary to support their growing economy in strategic locations but they also help to divest their dollar holdings without disrupting the global credit markets. Eastern African is logically choice for those acquisitions.

Source: earthtimes.org

Senate Democrats needed all the 60 votes at their disposal Thursday to muscle through legislation allowing the government to go $1.9 trillion deeper in debt.

The Financial Times reported on Wednesday that Athens was wooing Beijing to buy up to €25bn of government bonds in a deal promoted by Goldman.

Banks may start to rein in lending, putting the economic recovery at risk, if politicians keep attacking them and regulatory uncertainty persists, Blackstone Group LP Chief Executive Officer Steven Schwarzman said.

Regulatory uncertainly, OK, that is a factor. Contraction in lending (credit) started well before "banker bashing" became politically fashionable. The break down of total bank credit at all U.S. commercial banks indicates that the demand for credit has been falling steadily since the middle of 2009. Nearly all series, except for cash assets, are showing year-over-year contraction. As the assets supporting leveraged-consumption continue to implode, the loans behind the bubble have declined. Nothing short of the restoration of reckless credit, where reward does not justify the risk, will be able to restore the bubble dynamics.

Source: bloomberg.com

China’s $300 billion sovereign wealth fund is considering new investments in resource-related companies after bets on commodities producers from the U.S. to Kazakhstan paid off in 2009.

While you should never argue with direction of the tape, this does not mean that its quality should not be challenged.

Sales of new homes in the U.S. unexpectedly dropped in December, signaling the extension of a government tax credit has yet to shore up demand.

More of this unexpectedly garbage. Does this surprise anyone?

“While we’re past the bottom in housing, especially in sales and construction, we still have a long road to go,” said Adam York, an economist at Wells Fargo Securities LLC in Charlotte, North Carolina, who forecast a drop to 349,000.

Past the bottom in housing?

Depressionary bottoms are formations rather than single events such as proclamations that we're past the bottom. These formations, characterized by the saying bouncing along the bottom, represent the cycle between hope and fear. Obama campaigned on the slogan of hope. Roosevelt's famous quote "Only Thing We Have to Fear Is Fear Itself" suggests how history will repeat.

New homes sales are losing momentum.

New Home Sales And Change YOY, SA:

While average home sales price may have up ticked, it did so as supply increased. This suggests further price declines in the future.

Median Home Price to Months Supply Ratio (at current sales rate) (MHPMSR) - Median Home Price per Supply of Homes (at current sales rate):

There is a fine between hope and fear. It is line that will be crossed my times during this economic depression.

Source: bloomberg.com

“Today we’ll see quiet defensive trading ahead of the FOMC meeting,” said Jason Rogan, director of U.S. government trading at Guggenheim Partners LLC, a New York-based brokerage for institutional investors. “The market fully expects the Fed to reiterate low rates for longer. We may see a bit of concession leading up to the auction.”

If an unstoppable force meets an immovable object, what happens?

The U.S. bond market is created.

The defense of critical support, dubbed the push of the invisible hand, has been successful. The technical picture, however, suggests that while a battle may have been won the war still rages. TBT (2x inverse long bonds) shows contracting volume while maintaining both gap and neckline support. As long as this persists, it suggests waning downside force.

That which cannot break support with force will eventually reverse and attempt to break resistance with force.

Long Bonds 2x Inverse ETF (TBT):

Positive money flows from strong hands have not retreated despite the negative technical setup. Traders normally swarm for the kill when they sense blood in the water. We don't see this in the bond market. The battle between illusion (immovable object) and economic reality (unstoppable force) in the bond market is no trivial matter. The resolution of this war in terms of interest rates will have broad economic consequences. Consequences that would be deemed a threat to our national interests.

Source: bloomberg.com

Ford Motor Co said on Tuesday it will build the next version of its Ford Explorer SUV in Chicago starting in late 2010, adding 1,200 jobs that may include hires at a new lower wage negotiated with its union.

"We are restructuring select support functions to better align with our business needs and we are exiting three underperforming pilots," Home Depot CEO Frank Blake said in a memo to employees on Tuesday.

It is the second of two big job cut rounds in the retail sector. Sam's Club, the warehouse club unit of Wal-Mart Stores Inc, announced plans on Sunday to cut about 11,200 jobs, or 10 percent of its workforce.

Nearly one in five U.S. households ran out of money to buy enough food at least once during 2009, said an antihunger group on Tuesday, urging more federal action to help Americans get enough to eat.

After his worst political setback since he took office a year ago, President Barack Obama will vow to revive job growth and tame skyrocketing budget deficits in a crucial State of the Union speech on Wednesday.

If more lenders follow Bank of America it could clear the way for more mortgage companies to cut borrowers' principal balances on their primary loans. But administration officials appear wary of subsidizing such reductions with taxpayer money.

That could spark a backlash from critics who claim it's unfair to people who are still paying their mortgages on time and a bailout for banks that made reckless loans.

The article goes on to say that dramatic changes are needed (to keep the illusion rolling). Maybe the proceeds from the helicopter ben action figures sales could be used to modify principal.

Source: finance.yahoo.com

Japan’s sovereign credit rating outlook was lowered by Standard and Poor’s on concern Prime Minister Yukio Hatoyama’s administration lacks a plan to rein in the world’s largest debt load.

Clearly Japan remains the only country lacking a plan to rein in debt.

The yen pared gains immediately after the release, before resuming a rally against the dollar.

Yeah that persistent Yen strength despite the prevailing consensus. The Yen has slammed into formidable gap resistance. It sits over price like an anvil. There's some work to be done here, but I suspect the outcome will surprise the consensus.

Source: bloomberg.com

The special deficit panel would have attempted to produce a plan combining tax cuts and spending curbs that would have been voted on after the midterm elections. But the plan garnered just 53 votes in the 100-member Senate, not enough because 60 votes were required. Anti-tax Republicans joined with Democrats wary of being railroaded into cutting Social Security and Medicare to reject the idea.

Obama endorsed the idea after being pressed by moderate Democrats. The proposal was an amendment to a $1.9 trillion hike in the government's ability to borrow to finance its operations.

Does this news surprise anyone?

The census has started. How many workers are need to count the citizens? I bet a lot.

Stocks rebounded from an early slide Tuesday as stronger consumer confidence boosted hopes for the economy.

The linkage of confidence and the wealth effect is byproduct of the consumption driven economy. Rather than chasing market driven commentary, you should be asking what does the rebound in confidence mean for gold? The consumer expectations and gold commentary indicates that contrary to expectations that rising confidence will setup the next advance.

Source: finance.yahoo.com

“It’s clearly disappointing,” Simon Hayes, chief U.K. economist at Barclays Capital and a former Bank of England official, said in a telephone interview. “The recovery is going to be uneven. I think the Bank of England will halt quantitative easing in February, but if we don’t see sustained growth it’s likely we may see them extend it in the middle of the year.”

The plan, to be presented today to Senate Democrats, would include aid to state governments to prevent layoffs and additional funding for infrastructure projects, said the senator, who asked not be identified. The package also will likely include energy-related provisions such as incentives to weatherize homes, a Senate aide said.

Here it comes. $80B is the window-dressing price tag. This number is certain to grow in size after factoring pork and other special interests.

Source: bloomberg.com

The proposals to be unveiled by Obama and Vice President Joe Biden at the White House include a doubling of the child care tax credit for families earning under $85,000; a $1.6 billion increase in federal funding for child care programs and a program to cap student loan payments at 10 percent of income above "a basic living allowance."

Obama is seeking to offer some attractive options to taxpayers, mindful of recent setbacks including the loss of a traditionally Democratic Senate seat in Massachusetts to Republican Scott Brown. Monday's rollout is designed to show sympathy with a frustrated public. "

Sympathy = handouts, handouts = deficit spending, which is not dollar positive. Good thing the deficit task force is studying the problem until November.

Source: finance.yahoo.com

The report reflects a sharp drop in demand after buyers stopped scrambling to qualify for a tax credit of up to $8,000 for first-time homeowners. It had been due to expire on Nov. 30. But Congress extended the deadline until April 30 and expanded it with a new $6,500 credit for existing homeowners who move.

The big question hanging over the housing market this spring is whether a tentative recovery will stumble after the government pulls back support. The Federal Reserve's $1.25 trillion program to push down mortgage rates is scheduled to expire at the end of March -- a month before the newly extended tax credit runs out.

When reality fails to meet spin-induced expectations, programs will be extended, and quite possibly augmented for the the good of all. Of course, no one will critically review the effectiveness the programs being extended beyond the standard response wer're better off than if we hadn't done this.

This inevitably leads me to think of the Jesse Livermore quote,

All through time, people have basically acted and reacted the same way in the market as a result of: greed, fear, ignorance, and hope. That is why the numerical formations and patterns recur on a constant basis.

Source: finance.yahoo.com

Politicians will be watching the market's reaction closely.

Grover Norquist, the conservative head of Americans for Tax Reform, said the nation's investor class is increasingly calling the shots in elections. He says Obama is hurting himself with his bank bashing.

"A lot of Americans own 401(k)s -- and he's just made them a lot poorer," he said, creating "a lot of bitterness" among voters.

Now there's some spin. The recent decline has made Americans a lot poorer? On the surface, it looks like a reasonable argument. By extension, this argument implies that the stimulus under the current Administration has made them a lot richer.

The nominal stock market has rallied 38% in U.S. dollar terms since 2009.01. Many cite this percentage gain as the definition of richer. In a previous post titled, shades of 1932, it illustrates that this return is largely an illusion based on devaluation. When stock returns are priced in a constant currency, the 38% rally falls to 4%. This is illustrated in the LCSTRIGOLDR chart.

Bank bashing? It will fall victim to bureaucratic red tape and a new flavor of the day. The wealth effect derived from the equity rally is nothing more than an illusion. Few within the general public are signficantly "richer" in equities since 2009.01.

What matters is jobs. Devaluation and the false illusion of the wealth effect cannot create them. Job creation takes investment, innovation, and rising aggregrate demand.

Source: finance.yahoo.com

US Mint American Silver Eagle sales have already scored their best ever January. Who would have thought? After all, there is still a full week left in the month. On top of that, the bullion coins are rationed, they were unavailable for seven days, and U.S. silver futures tumbled 8.1 percent last week (6.7 percent in London).

Concern that short-sellers accelerate stock declines may prompt the Securities and Exchange Commission to adopt a rule next month aimed at curbing bearish bets when equities are plunging.

Similar to the movie Groundhog day - a story of a man who is living the same day over and over again. The asymmetrical bias towards the wealth effect. Rising stock prices are good. Falling stock prices are bad. Devaluation, the hidden tax, is good because it supports higher prices.

Source: bloomberg.com

The rising prices, coupled with the joblessness caused by the recession, have again made copper recycling attractive to thieves. Since June 1, police have investigated 129 copper-related thefts in the state.

Remember, the official unemployment rate is 10%, wink-wink. Spin, MOPE, economic propaganda only works on those too lazy to think.

Source: delawareonline.com

The bipartisan 18-member panel backed by Obama would study the issue for much of the year and, if 14 members agree, report a deficit reduction blueprint after the November elections that would be voted on before the new Congress convenes next year. The 14 would have to include at least half of the panel's Republicans -- a big obstacle.

"These deficits did not happen overnight, and they won't be solved overnight," Obama said in a statement. "The only way to solve our long-term fiscal challenge is to solve it together -- Democrats and Republicans."

The above comments reflect not only the importance of deficit spending but also timing of it. Deficit reduction is good idea, but not until we do some more deficit spending to stimulate the economy, really make things look good, for the mid-term elections

Either the government keeps spending or the economy will continue to contract under the weight falling consumption. The side effect of such spending, the reason for the creation of deficit task force, is increased deficits and public sector debt issuance. Politicians don't like deficits, right? Well, that depends on approval ratings.

Of course, raising taxes is an option, but public reaction of pitch-fork-to-the-arse means one-term Administration.

That leaves the only political viable option of devaluation. Yes, devaluation is a tax, but few citizens understands it as such. And, you don't see a lot of education on the subject. Devaluation, in theory, reduces the size of the debt burden. It's a political win-win. Well, maybe not so much. Fiat money is a confidence game. Push devaluation too far and confidence will begin to falter. We are seeing that right now. If confidence falters too much, the biggest and possibly only direct buyer of Treasuries will have the initials B.B.

Source: finance.yahoo.com

He said a new stimulus spending bill emerging in Congress -- the White House is calling it a jobs bill -- must include tax breaks for small business hiring and for people trying to make their homes more energy efficient -- two proposals he wasn't able to get into a bill the House passed last month.

Stimulus II is coming and will be as ineffective as the first one. Of course, this means bigger mind-numbing bond auctions.

Source: finance.yahoo.com

Coming up next week, the Treasury Department will sell $44 billion in 2-year notes on Tuesday, followed by $42 billion in five-year debt (UST5YR 2.34, 0.00, -0.17%) the next day. It will also auction $32 billion in seven-year notes on Thursday.

Auctions as far as the eye can see. Just when the market distruptions (equity, bond, and gold) from one auction begin to subside, another arrives to wreck its havoc.

The size and frequency of these auctions have made us apathetic to such announcements. Unfortunately, apathy does not mitigate the price, in terms of the future purchasing power of the dollar, of the Keynesian solution.

Source: marketwatch.com

Source: treas.gov

Source: en.wikipedia.org/wiki/Keynesian_economics

"Under the watch of Ben Bernanke, the Federal Reserve permitted grossly irresponsible financial activities that led to the worst financial crisis since the Great Depression," Feingold said in a statement.

This has been a crisis in the making for decades. Greed, and its consequences, knows many accomplices. Ever wonder why Bernanke was hand picked for the job? As a student of the depression, the job picked him.

Large Cap Stocks Total Return Index to Long-Term Government Bonds Total Return Index:

All the long-term charts say the same thing, yet the blame is always shouldered by those sitting in the chair during the well-after-the-fact realization phase.

Source: news.yahoo.com

Global liquidity is tightening a little bit and that's usually bad for a hard asset such as gold," says Thomas Winmill, manager of the Midas Fund. "If we see fiscal disciple [and] monetary discipline in the U.S., I would say we might see gold go back to its marginal cost of production, which is about $800 per ounce," nearly 30% below current levels.

Global liquidity is tightening? A few weeks ago the world was talking about continued stimulus efforts to support the fragile global recovery. Then China, likely talking down that which they want the most, taps on the brakes at little to create uncertainly. Like pavlovian dogs, the hard asset bears come charging out of hibernation.

How easily we forget that direct (impossible to trace) bids for the last treasury auction jumped sharply.

Rick Klingman, managing director at BNP Paribas, said: "It is unusual to see such a spike in the direct bid and I would imagine it is one big bidder. There is no way we will find out who it is, not now, or ever."

I would not be shocked to learn that the initials behind those bids were B.B. It's called debt monetization, and is hardly an indication of global liquidity tightening.

But that's how it works, fear creates commentary. Gold is and will alway be protrayed as barberous relic during corrections, because it works to shakeout those that cannot control their fear.

Source: finance.yahoo.com/tech-ticker/

Source: ft.com

Financial stocks fell and the dollar weakened on concern President Barack Obama’s plan to rein in banks will dent U.S. earnings. Emerging-market shares dropped for a third day on speculation China will raise interest rates.

The continued unwinding of leverage means that relying on real growth is out of the question. The illusion of wealth through devaluation and fictitious FASB asset valuations have been driving this so called recovery. Any strategy, regardless of the nature of its intentions, that disturbs the illusion will be quickly discarded. The potential for another Waterfall in assets remains real under the forces of a depressionary debt liquidation cycle.

Source: bloomberg.com

President Barack Obama, tapping into voter anger over bank bailouts, called for limits on the size and trading activities of financial institutions in order to reduce risk-taking and prevent another financial crisis.

The Roosevelt administration did the same thing in 1933. Obviously, banking reform, though repealed in 1999, did not prevent another financial crisis. The seeds of the current financial crisis were sown well before the repeal of Glass-Steagall.

Every sitting administration is reminded, at times with a figurative 2x4 across the head, that populace anger is centered around jobs, jobs, and jobs. The focus on banking reforms will fade when the general populace finds itself increasingly unemployed.

Expect the focus, in terms of another jobs bill/stimulus, to return soon.

Source: bloomberg.com

Hidden behind accounting fictions, the politically unspeakable reality is that public employee pension systems are under-funded by more than $2 trillion. Add more than $1 trillion in unfunded health-care benefits for retired public employees, and state governments face protracted structural deficits ranging from challenging to insurmountable.

First, there is a correlation in government between the creation of long-term liabilities and the propensity to rely on fantasy math.

Second, the parties to the arrangement suffer to the extent they fail to understand the math.

Third, there is an inverse correlation between the magnitude of a shortfall and the visibility of the issue. Precisely because the size of the problem precludes easy answers, it lies beneath the surface of the public dialogue.

Deny, deny, deny until a scandal breaks. Then the public is horrified, the printing press heats up, and the debt burden grows larger. Throw away your insurance (gold) in the face of the paper tiger if you like, but denial has a limited half life. When denial turns to scandal, real insurance, not paper will be difficult to secure.

Source: bloomberg.com

President Barack Obama will offer proposals to limit financial institutions’ size and trading activities as a way to reduce risk-taking, an administration official said.

Rules? Rules in the form of the reintroduction of banking reform? The repeal of Glass-Steagall in 1999, allowed those granting credit (lending) and using of credit (investing) to be under one roof. This opened to the door to the same abuses that produced the banking reforms in 1933. Still, reintroduction of banking reform will do little to slow the next round greed-induced profit. Money always finds a way. Excessive regulation only serves to send these activities offshore.

Source: bloomberg.com

"We need a jobs bill. We need short-term, focused strategies to create jobs, real fast," said Sen. Bob Casey, D-Pa. "If the dominant message isn't about jobs and spending, we'll be making a difficult challenge exponentially more difficult."

Translated - more spending, more debt, more devaluation.

Source: news.yahoo.com

Brown: Mass. victory sends 'very powerful message'

"There are messages here. We hear those messages," said Axelrod. "There is a general sense of discontent about the economy. And there is a general sense of discontent about this town"

Clearly messages are being sent, but is anyone listening? One thing remains clear, the message of no more reckless spending will ignored completely as long as bank credit, updated through December 2009, continues to deteriorate under Keynsian decision-making.

Where's the picture of that gnarly roster?

Breakdown of Total Bank Credit Growth: Year-over-Year Growth for Total Loans, Business Loans, Real Estate Loans, Home Equity Loans, Consumer Loans, and Cash Assets for Commercial Banks in the US:

U.S. stocks were having their worst day of 2010 on Wednesday as lending restrictions in China worried investors about the global economic recovery, while a conservative outlook from IBM weighed down technology shares.

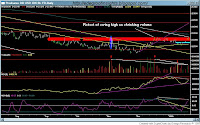

Hurray for the U.S. dollar day. As goes the dollar, so goes stocks, commodities and gold in the inverse. The U.S. dollar ETF, UUP, has once again moved into the September 09 gap. While volume has increased today, it still lags that of the swing highs within the gap. For UUP to turn bullish it needs to break the gap and swing highs (resistance) on an explosion of force or what is called a technical sign of strength. This is something it has been unable to do thus far. The force behind the rally will dictate its longevity.

Source: finance.yahoo.com

Greek bonds tumbled, pushing the yield on the two-year note up by almost 90 basis points, on concern the government will struggle to sell the debt it needs to fund the biggest budget deficit in the European Union.

Too bad Greece doesn't have a direct bidder with the intials BB.

Source: bloomberg.com

The US dollar for those that say it is looking good.

See the gnarly looking roster on jsmineset.com for a good laugh.

Today we saw a fill of gap resistance. While price closed above the gap, it did so with a significant contraction in volume. The old schoolers would call this a poor tape. A poor tape implies weak force. Price that cannot surmount resistance with force will eventually reverse and test previous support.

U.S. Dollar Index ETF (UUP)

President Barack Obama announced Tuesday he'll ask Congress for $1.35 billion to extend an education grant program for states, saying that getting schools right "will shape our future as a nation."

$1.35B for education, $33B more for war, and how much more for the next generation of targeted stimulus? This is not a question of merit but rather limit to what is perceived as the infinite money well by some. If we do not exercise some measure of self-control soon, the markets will do it for us regardless of the consequences.

Source: news.yahoo.com

International demand for long-term U.S. stocks, bonds and financial assets rose in November as private investors purchased a record amount of government securities, a Treasury Department report showed.

“The world is still not a safe place and U.S.-based assets have always stood the test of time during periods of great uncertainty,” said Chris Rupkey, chief financial economist at Bank of Tokyo-Mitsubishi UFJ Ltd. in New York. “The worldwide recession may be technically over, but global investors are not so sure.”

This is not about recession but rather confidence concerns - confidence in US securities, or USA, Inc. This is to say, confidence in the U.S. dollar. While demand for long-term U.S. securities rose in aggregate (Grand Net), the up tick remains within the context of down trend. Foreign purchases and sales of long-term domestic and foreign securities by type chart reveals that nearly all asset classes declined in terms of velocity and acceleration in November. The only exceptions were U.S. Treasury Bonds & Notes and Corporate Stocks.

The major foreign holders of treasury securities as a percentage of the total chart is even more revealing. China has quietly reduced their marginal purchases of US treasuries since the summer 2009. China is a major buyer of US treasuries, thus, any change is highly significant. For now, the United Kingdom, which in and of itself raises even more concerns, has absorbed the marginal supply.

Flow the money, not the talk!

FOREIGN PURCHASES AND SALES OF LONG-TERM DOMESTIC AND FOREIGN SECURITIES BY TYPE:

MAJOR FOREIGN HOLDERS OF TREASURY SECURITIES As A % of TOTAL:

Source: bloomberg.com

Global food prices are rising again with the United Nations Food and Agriculture Organisation (FAO) food price index hitting 168 points in November, the fourth consecutive month of increase and the highest since September 2008.

Several reasons have been highlighted for the rising prices. However, FAO has possibly for the first time highlighted the 'growing appetite by speculators and index funds for a wider commodity portfolio investments on the back of enormous global excess liquidity', as exacerbating the situation.

An inevitable consequences of infinite QE is that money will seek returns outside of preferred asset classes.

Source: business.asiaone.com

The surprising demand for Treasury notes has come in the form of "direct bids", the term used for US institutional investors who bypass the so-called primary dealers that underwrite government bond sales.

"It appears to us that someone is trying to hide their apparent interest in owning these auctions from the rest of the market," said David Ader, strategist at CRT Capital.

The COT money flows reveal continue support for the 10- and 30-year bonds at an important technical juncture. This unusual and highly focused purchase is certainly not a coincidence.

Source: ft.com

The assault by a handful of determined militants dramatized the vulnerability of the Afghan capital, undermining public confidence in President Hamid Karzai's government and its U.S.-led allies.

Being unconquerable lies with yourself, being conquerable lies with the enemy. - Sun Tzu.

Source: news.yahoo.com

The Fed's balance sheet -- a broad gauge of its lending to the financial system -- rose to $2.274 trillion in the week ended January 13 from 2.216 trillion in the prior week.

Keep piling it on.

"With the data we're getting out of the housing market right now so poor, I don't see them ending it in March. I see them somehow phasing it out quietly without notice."

Right, somehow phasing it out quietly.

Source: reuters.com

Let me get right to the point. Gold’s going to $5,000 an ounce.

For many of you this long term gold chart is nothing new. $5,000, while aggresive, could prove to be conservative.

Federal Debt Held by Foreign & International Investors (FDHBFIN) and the Equilibrium Price (FDHBFIN/OZ:

Source: dailymarkets.com

A lot of the newsletter writers are calling for a top and a correction in the PMs.

I try not to follow the opinions of others.

Over the years, holding the PMs has been great, but very often, for long periods of time, frustrating.

Precious metals stocks as a group have underperformed gold at times. Many of the well-known gold indices have been and continue to be populated by some boat anchors. As time passes many of those name have been and well be removed. Check out the updated composition of the HUI and GDX. There are new names. In time, 1930's history will repeat.

S&P Gold (Formerly Precious Metals Mining)* to Gold Ratio:

* S&P Gold from 1945, Barron's Gold Stock Index from 1939-1945, 1922-1939 Homestake Mining:

“Personnel changes at the Ministry of Finance do not fundamentally change the positive supply/demand dynamics of the yen,” Adam Cole, London-based global head of currency strategy at RBC Capital Markets, wrote in a note to clients, referring to the recent resignation of Japanese Finance Minister Hirohisa Fujii. Japanese politics have diverted attention from events that would strengthen the yen, he said.

Misdirection, or fading the spin, is a common trading tactic. A reversal in Yen money flows revealed a change weeks ago. A rising Yen despite chatter suggests that the spin has been faded once again.

Yen and the Commercial Traders COT Futures and Options Stochastic Weighted Average of Net Long As A % of Open Interest:

Yen and the Nonreportable Traders COT Futures and Options Stochastic Weighted Average of Net Long As A % of Open Interest:

Source: bloomberg.com

The Ohio Valley Gold & Silver Refinery is making its rounds through Missouri this month, letting cash-strapped citizens exchange goods for a check.

“Obviously, the dollar has decreased in value, so the precious metal market has increased,” he said. “Right now, gold has value. Sell while it’s high.”

Get rid of that useless broken gold and silver for valuable U.S. dollars.

Osmosis is diffusion water through a semi-permeable membrane from an area of high to an area of low concentration without the input of energy. At first, I thought the study of science and money were separate disciplines. Over time, I learned that the line of distinction was more diffuse than coherent. Knowledge, like osmosis, always separates the money from weak to strong hands without the input of energy.

Source: columbiatribune.com

I enjoy your work. This imminent/inevitable breakdown of the long bond is one of the most important items in the market today. It gets little media coverage (what else is new?)!

Also, in the past (on Jsmineset) you have alluded to quantitative easing being good for stocks in general, and small cap stocks in particular. Am I understanding you correctly? If I am understanding you correctly, than why?

JGB

Weimar Republic model serves as a classic example of rising equities prices in the face of deteriorating economic conditions due to extreme currency devaluation. While the U.S. dollar's decline has been orderly, it has provided a similar boost to equities since 2001. F-TV describes the equity performance as a series of cyclical bull and bear market since 2000. These are nothing more than movements within a depressionary trading box.

S&P 500:

The devaluation boost, however, is little more than a currency illusion. This illusion is revealed by in shades of 1932 commentary. Gold-adjusted, or devaluation normalized, stock performance reveals the true trend.

Small cap stocks have follow a similar but clearly unique trend.

Small cap stocks total return index to gold ratio:

Large cap stocks total return index to small cap stocks total return index:

The question is why? Does quantitative easing favor small cap stocks? Does it matter?

Questions to ponder for the comment board.

Undeterred by the rising anger on Main Street and the populist backlash in Washington D.C., Wall Street firms are poised to pay record bonuses for 2009.

You expected otherwise?

2009 "was just a great year" for Wall Street, Craig says. "But where the gap is...what they do and what they did caused a systemic risk to our system. We have to balance those two issues because there is a public interest in terms of what they did; the taxpayers had to clean it up. "

2009, was another great year, made possible by

1. FASB,

2. Reward without risk (which leads to 3)

3. Taxpayer money and infinite QE

4. Just enough complexity to keep the public confused.

Source: finance.yahoo.com