History is repeating, but few recognize it. As a result, history repeats and the public finds itself shocked by these seemingly ‘new’ and unusual events.

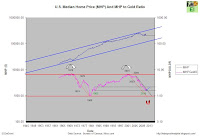

U.S. Median Home Price (MHP) And MHP to Gold Ratio

S&P Homebuilders Index (HB) AND HB to U.S. Median Home Price (HBMHPR)

Headline: US house price drop accelerates

US house prices have suffered their biggest quarterly fall since the collapse of Lehman Brothers, underlining the scale of the headwinds still facing the world's biggest economy.

Average house prices slumped 3pc in the first three months of this year, a decline that pushed the number of homeowners in negative equity – where a mortgage is higher than the value of a property – to 28pc from 22pc a year earlier, according to new research from Zillow, a major US property website.

Source: telegraph.co.uk

Thanks Bob!

0 comments:

Post a Comment