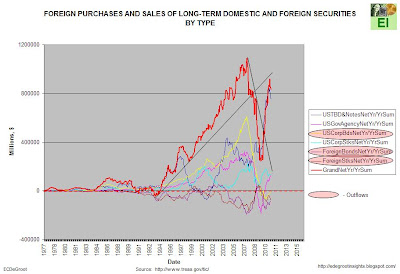

FOREIGN PURCHASES AND SALES OF LONG-TERM DOMESTIC AND FOREIGN SECURITIES BY TYPE:

The three horsemen hold over 50% of total issuance.

Major Foreigner Holders of US Treasury Securities: The Three Horsemen

Headline: China US bond purchases decline for 3rd month

China's holding's of US debt fell for the third month in January, while buying from Japan and Britain picked up, the Treasury Department said Tuesday.

Chinese holdings of Treasury securities fell $5.4 billion, or less than half a percent, to $1.15 trillion in January from December.

January's level was $20.6 billion lower than the peak of $1.175 trillion in October.

China's holdings are keenly watched as a sharp turn away from US bonds by their biggest foreign buyer could send US debt costs skyrocketing.

Moreover, leaked diplomatic cables in February vividly showed China's willingness to translate its massive holdings of US debt into political influence on issues ranging from Taiwan's sovereignty to Washington's financial policy.

Source: news.yahoo.com

0 comments:

Post a Comment