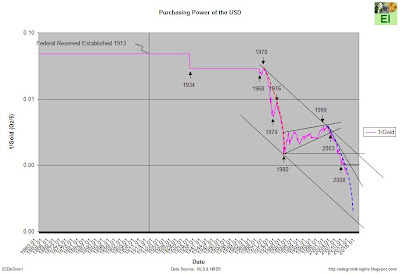

The secular trends are often revealed by simple analysis. The stock market is heavily influence by devaluation of the currency that denominates it; the U.S. dollar denominates US stocks. The stock market invariably churns within ‘depressionary boxes.’ Depression boxes are characterized by aggressive currency devaluation. Currency devaluation, a form of indirect default, is a centralized response, consistent over time, meant to mitigate consequences of debt liquidation after periods of excessive debt creation. This is why Roosevelt confiscated gold during Great Depression and revalue it from $20/oz to $35/oz. It was nothing more than massive devaluation.

History, regardless of public perception or understanding, is once again repeating. The purchasing power of the USD is declining.

Purchasing Power of the USD

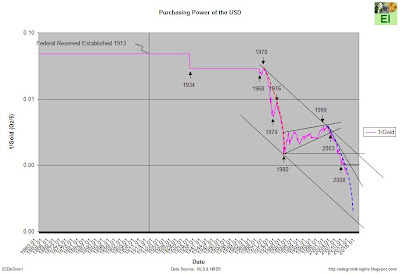

And, the stock market is following historical precedence.

Devaluation Steps: S&P 500 Total Market Return and Inverse price of Gold

0 comments:

Post a Comment