The sell off in gold and silver is nothing more than a transfer of control from weak to strong hands. These markets will turn, unexpectedly so in the headlines, once the paper fuel has been exhausted and concentration of funds emerges.

Why?

The fundamentals debt and socialism, thus, gold and silver have not changed. For example, yesterday's federal budget reveals that heavily hyped spending cuts proposals are merely crumbs of a very large and growing deficit pie.

Jim's formula illustrates yet another rollover within a secular downtrend. This rollover will be addressed with classic lip service, but behind the scenes massive, largely quiet, liquidity injections will be the solution.

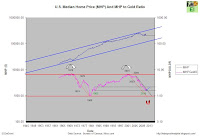

US Federal Budget (Surplus or Deficit As A % of GDP, 12 Month Moving Average) and Gold London P.M. Fixed:

Real (constant currency) revenues or the money government receives to pay the bills, continue to contract faster than real outlays. In other words, the government, like the post office is hemorrhaging red ink.

Real or Gold Adjusted Federal Total Receipts 12-Month Moving Average (TR12MA) AND Federal Total Receipts 12-Month Moving Average Year-over-Year Change (TW12MA12LN)

Real or Gold Adjusted Federal Total Outlays 12-Month Moving Average (TO12MA) AND Federal Total Outlays 12-Month Moving Average Year-over-Year Change (TW12MA12LN)

As Jim has said numerous times, gold is all about debt (and the solutions to mitigate it). Deficit spending cannot be cut without Depressionary consequences, so it won’t. History suggests that governments pay their bill through devaluation rather than discipline. The chart below illustrates only a portion of those bills; the appropriate expression should be GASP! This is why capital is buying gold.

Total Credit Market Debt As A% GDP

Headline: Spending cuts not expected to dent $1.5T deficit

The $38 billion in spending cuts agreed to last week won't prevent this year's budget deficit from setting another record high, estimated at $1.5 trillion.

Most of the agreed-to spending cuts either affect future budgets or amount to accounting gimmicks that won't reduce actual spending.

The Treasury Department reported Tuesday that the deficit already totals $829.4 billion through the first six months of the budget year -- a figure that until 2009 would have been the biggest ever for an entire year. For March alone, the government ran a deficit of $188 billion.

Source:

finance.yahoo.comSource:

fms.treas.gov