Ex post analysis (after the fact) is always easier than ex ante. Unfortunately, often cited retrospective analysis doesn’t help investors anticipate the big and profitable events. Investors with vision anticipate and survive; those without react and perish.

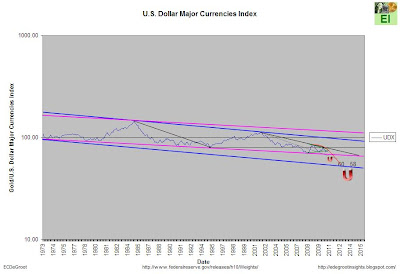

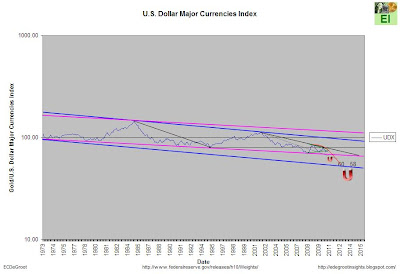

Fractal analysis reveals multiple waterfall declines in the dollar since 1970. Today’s acceleration of the decline, in particular, has the potential to instill ‘the fear of God’ for those unprotected.

Purchasing Power of the USD

U.S. Dollar Major Currencies Index

Do not underestimated what people like Jim Sinclair, Dan Norcini, and James Turk (see below) are saying. The

backwardation in silver remains persistent and pronounced despite the recent rally. This suggests heavy demand for physical silver. In addition, connected money continues to cover their shorts into the teeth of the rally. These two events are highly unusual and suggest growing strain in the silver market. If gold begins to display a similar setup, the unfolding waterfall decline will intensify quickly.

Silver London P.M Fixed and the Commercial Traders COT Futures and Options ZScore Weighted Average of Long & Short As A % of Open Interest

Headline: James Turk - The Waterfall Decline in the US Dollar Has Begun

With gold and silver taking off after the Fed statement, today King World News interviewed James Turk out of Spain. When asked about the action Turk stated, “I've just finished reading the Federal Reserve's announcement of its meeting concluded earlier today. I've also scanned some of the excerpts from Bernanke's press conference and Eric, I am struck by the inconsistencies. The precious metals markets must be seeing it the same way I am given the strength in gold and silver after the announcement's release.”

The Dollar Index has broken below all of its previous lows except for the last one at roughly 71 on the index. When that gives way you could see incredible panic selling ensue.

The bottom line is the market is calling the Fed's bluff. Investors don't believe the Fed will stop its purchases of US government debt on June 30th and for what it is worth, I don't either.”

Source:

kingworldnews.comFrom Bob