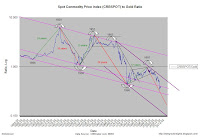

Dow Jones Industrials to Gold Ratio:

Dow Jones Industrial to Gold Ratio Fourth Consolidation Zoom:

The Commerce Department's initial estimate of the economy's performance in the January-to-March quarter, released Friday, provided more evidence that the economy is strengthening. It marked the third straight quarterly gain as the United States heals from the longest and deepest recession since the 1930s. Still, growth was weaker than in the fourth quarter of last year, when the economy grew at 5.6 percent.

Speaking to a midtown audience of real estate developers, Ravitch said he does not expect the state to reach a budget deal any time soon, despite the state's desperate fiscal situation. The budget is nearly one month late and Ravitch says there are no external triggers forcing lawmakers and the governor to act.

"States can’t go into bankruptcy. They are not included in the bankruptcy code," he says.

An oil spill that threatened to eclipse even the Exxon Valdez disaster spread out of control and drifted inexorably toward the Gulf Coast on Thursday as fishermen rushed to scoop up shrimp and crews spread floating barriers around marshes.

Germany's foreign minister went so far Thursday as to suggest that the European Union should create its own rating agency. He spoke after downgrades of Greece and Portugal roiled financial markets and stoked fears that Europe's debt crisis was spreading.

The United States is "doing the right thing" by pursuing a diplomatic solution to the threat that Iran may soon gain a nuclear weapon, but the world cannot afford to wait too long, Israel's defense minister said Tuesday.

Wisconsin's statewide pension system for public employees may not be as well-funded as the state reports, with a new study estimating it could be as much as $10.9 billion short in meeting its obligations just to teachers.

While the state estimates that the Wisconsin Retirement System is nearly 100% funded, the report by the conservative Manhattan Institute and Foundation for Educational Choice warns that the amount could be far less.

Harrisburg, Pennsylvania, which has missed $6 million in debt payments since Jan. 1, should consider seeking Chapter 9 bankruptcy protection, City Controller Dan Miller told a three-hour special committee hearing.

Managed colonies lost to all causes reached 33.8 of the total, compared with 29 percent a year earlier and 35.8 percent during the winter of 2007-2008, the U.S. Department of Agriculture said today. About 28 percent of surveyed beekeepers reported losing hives without any evidence of dead bees, a sign of Colony Collapse Disorder, compared with 26 percent the previous year and 32 percent the year before that.

Bees are essential for the health of pollinator-dependent crops such as almonds and blueberries.

Decisions by homeowners to walk away from mortgages they can afford are accounting for more defaults, according to Morgan Stanley.

About 12 percent of all mortgage defaults in February were “strategic,” up from about 4 percent in the middle of 2007, New York-based Morgan Stanley analysts led by Vishwanath Tirupattur wrote in a report today.

Goldman Sachs may soon settle its fraud case with the U.S. regulator, the New York Post reported on Thursday, opting to end a legal fight rather than endure a repeat of the public flogging it received this week.

Signs of an improving domestic economy are helping send stocks higher for the second straight day. Major indexes all rose in early trading Thursday.

Other countries, including Britain, Australia, New Zealand, Israel, Sweden, Norway and Denmark, have gotten rid of their lowest currency denomination.

“In fact, a penny cannot even buy a penny anymore. It costs far more than a cent to produce and distribute each penny.”

Spain’s credit rating was cut to AA from AA+ by Standard & Poor’s Ratings Services. The outlook is negative, S&P said.

“RBS has begun its transition from problem to opportunity - an opportunity for the U.K. government, without whose decisive support we would not be here today,” RBS Chairman Philip Hampton said in a statement released before today’s annual shareholder meeting in Edinburgh.

Europe’s worsening debt crisis is intensifying pressure on policy makers to widen a bailout package beyond Greece after a cut in the nation’s rating to junk drove up borrowing costs from Italy to Portugal and Ireland.

Prices on beef, port and chicken have already gone up, and the U.S. Department of Agriculture said on Tuesday that they could continue to rise, 10TV's Jeff Hogan reported.

Beef and pork prices have jumped more than 20 percent recently and chicken prices have also increased.

Greece’s securities regulator banned short selling on the Athens stock exchange for two months from today as stocks around the world continued to fall after Greece’s credit rating was cut to junk.

World markets tumbled Wednesday amid acute fears that Greece's debt crisis would spread like wildfire through Europe after a leading credit ratings agency downgraded the country's debt to junk status and cut Portugal's rating as well.

As U.S. cities and towns wrestle with financial problems, investors are finding a new way to profit on their misery: by buying derivatives that essentially bet municipalities will default.

Failing to curb federal budget deficits would do "great damage" to the U.S. economy in the long run, Federal Reserve Chairman Ben Bernanke warned Tuesday.

U.S. stocks tumbled on high volume on Tuesday as investors shunned risk after the credit ratings for both Greece and Portugal were downgraded.

"In order to pay the interest and the bill when it comes due, we'll simply have to issue more IOUs. That, to me, is Ponzi-like," Gross said. "It's a game that can never be finished."

Now the real question, what would the invisible hand be telling us through a break of resistance in US long bonds?

Dan Montgomery doesn't have many kind words for his elected officials. The high school English teacher from Skokie says Illinois politicians spent years neglecting their obligations to the state's public pension funds and now want workers to foot the bill.

"We lifted that board up and the coins were in a little sack... My wife is dreaming of her new countertop and I think she very much deserves it so that's where the money's going to go, into our new kitchen," said Carter.

“ We think that we're now having a continuous, rapid decline of gas in storage. By summer, it could get to be alarming.” “We would expect gas prices to get above $8 in the August-September range.”

“A lot of Canadians didn’t agree with giving GM a second chance. Quite frankly, I can respect that,” he says. “We want to make this a company all Canadians can be proud of again. That’s why I’m here to announce we have repaid our government loans, in full, with interest – five years ahead of the original schedule.” (The American version of the ad is nearly identical.)

When the governments of the United States, Canada and Ontario decided to pump more than $60-billion into GM last year to keep it from sinking, they agreed to convert the vast majority of the cash into shares, so as to not saddle the business with too much debt. A sliver of the money – about $8.4-billion (U.S.) – remained as loans, and that’s what has been repaid. Big shareholders, the taxpayers remain.

Had he said those words, quite frankly, I could have respected that. It would have made GM a company I can be proud of again. It would also have been better than trying to fool the stupid into believing GM had just accomplished the impossible – the complete payback of $60-billion in less than a year.

The recovery is picking up steam as employers boost payrolls, but economists think the government's stimulus package and jobs bill had little to do with the rebound, according to a survey released Monday.

The "First New Deal" (March 8, 1933) dealt with groups; from banking and railroads to industry and farming.

A "Second New Deal" in 1934-35 included the Wagner Act to promote labor unions, the Works Progress Administration (WPA) relief program, the Social Security Act, and new programs to aid tenant farmers and migrant workers.

Among the considerations still in the balance: A big provision being sought by Warren Buffett in recent weeks. A key Senate committee had changed its proposed overhaul of derivatives regulation after lobbying by Mr. Buffett's Berkshire Hathaway Inc., potentially helping the famed investor avoid a financial hit, congressional aides say.

Mr Schauble said no decision had yet been taken by Berlin or the European Union and that the outcome may yet be "negative". "It depends entirely on whether Greece goes through with the strict austerity in coming years," he told Bild Zeitung.

Retailers are enjoying this return to form. "Retailers are already well on their way to their next bull market," says Markman, noting several retail indexes and ETFs have returned to 2007 highs.

It’s more likely than not that we’ll need an IMF program in at least one more country in the euro area over the next two to three years,” Rogoff, a former IMF chief economist who has co-authored studies of financial and sovereign debt crises, said in a telephone interview. “The budget cuts needed in Europe in many countries are profound.”

Reflecting on financial history and last round of massive government stimulus in the early 1990s, after which the S&P rose five-fold, Markman says the S&P could hit 3000 by the end of the decade. Recalling "Something along those lines could happen again," he says.

The International Monetary Fund is speeding up efforts to deliver funding help to Greece, IMF Managing Director Dominique Strauss-Kahn said Sunday, following a meeting with Greece's finance minister.

The Greek government on Friday formally asked euro-zone countries and the IMF for help. Euro-zone states have pledged to loan Greece up to €30 billion in the first year of any aid program, while the IMF is expected to provide a further €15 billion.

An explosion caused by a torpedo likely tore apart and sank a South Korean warship near the North Korean border, Seoul's defense minister said Sunday, while declining to assign blame for the blast as suspicion increasingly falls on Pyongyang.

The overhead gaps were created on heavy volume, so it will take a fair amount of upside energy and/or time to chew through them.

Thousands march around the State Capitol Wednesday in Springfield, Ill., where protestors were urging state lawmakers to raising the income tax to avoid more budget cuts. State officials were bracing for a potential shutdown of the building, but the protestors were outside listening to speeches.

“Inflation remains subdued,” said Joseph Brusuelas, president of Brusuelas Analytics in Stamford, Connecticut. Limited price pressure “provides an extraordinary amount of comfort to Fed policy makers. They can stay on hold well into 2011.”

Sales of new homes surged 27 percent last month, bouncing off the previous month's record low and blowing past expectations as better weather and government incentives boosted sales.

Greek Prime Minister George Papandreou called for the activation of a joint eurozone-International Monetary Fund financial rescue to pull his country out of a major debt crisis.

When prices are going up faster than the money supply, the people begin to experience a severe shortage of money, for they now face a shortage of cash balances relative to the much higher price levels.

With stated-income loans, the banks did not ask for supporting documents like W2 forms and pay checks. They did not verify statements about income against what was reported to the IRS. Yet the first job of a bank in lending is to check the supporting documents.

Following civil charges being filed against Goldman Sachs, what is clear now is that the crime of stated-income mortgages deserves to be explored fully by criminal prosecutors.

Home sales rose more than expected in March, reversing three months of declines, as government incentives drew in buyers and kicked off what's expected to be a strong spring selling season.

In 1998, Ashanti Gold was the 3rd largest Gold Mining company in the world. The first "black" company on the London Stock Exchange, Ashanti had just purchased the Geita mine in Tanzania, positioning Ashanti to become even larger. But in May 1999, the Treasury of the United Kingdom decided to sell off 415 tons of its gold reserves. With all that gold flooding the world market, the price of gold began to decline. By August 1999, the price of gold had fallen to $252/ounce, the lowest it had been in 20 years.

Ashanti turned to its Financial Advisors - Goldman Sachs - for advice. Goldman Sachs recommeded that Ashanti purchase enormous hedge contracts - "bets" on the price of gold. Simplifying this somewhat, it was similar to when a homeowner 'locks in' a price for heating oil months in advance. Goldman recommeded that Ashanti enter agreements to sell gold at a 'locked-in' price, and suggested that the price of gold would continue to fall.

President Barack Obama suggested Wednesday that a new value-added tax on Americans is still on the table, seeming to show more openness to the idea than his aides have expressed in recent days.

Any meaningful follow through on tarriffs, duties, or sanction will have similar consequences to Smoot-Hawley or Tarriff Act of 1930. This rhetoric bears close attention as many remain blind to the lessons of history.

Any meaningful follow through on tarriffs, duties, or sanction will have similar consequences to Smoot-Hawley or Tarriff Act of 1930. This rhetoric bears close attention as many remain blind to the lessons of history.The United States and China have announced new anti-dumping steps against each other over aluminum, nylon and optical fiber, possibly reviving strains over trade and currency that had eased in recent weeks.

The European Union's statistics office Eurostat said that Greece's budget deficit in 2009, as a percentage of economic output, was 13.6 percent. That's up from the previous estimate of 12.9 percent and nearly double the 7.7 percent recorded in 2008.

Greece's total government debt as a proportion of GDP stands at a massive 115.1 percent, a burden so large that some analysts think it will have trouble paying it over coming years even if a bailout saves Athens from default this year.

The Obama administration crowed about the "turnaround" at GM and fellow bailout recipient Chrysler LLC, saying the government's unpopular rescue of Detroit's automakers is paying off.

Toyota's safety problems and a buffed-up lineup of offerings from Detroit's Big 3 are rubbing the tarnish off car buyers' perceptions of U.S. models. An Associated Press-GfK Poll shows that 38 percent favor U.S. vehicles while 33 percent prefer Asian brands, a significant improvement for U.S. automakers compared to four years ago.

Our dwindling supply of phosphorus, a primary component underlying the growth of global agricultural production, threatens to disrupt food security across the planet during the coming century. This is the gravest natural resource shortage you've never heard of.

The geographic concentration of phosphate mines also threatens to usher in an era of intense resource competition. Nearly 90 percent of the world's estimated phosphorus reserves are found in five countries: Morocco, China, South Africa, Jordan, and the United States. In comparison, the 12 countries that make up the OPEC cartel control only 75 percent of the world's oil reserves.

A Senate panel approved legislation Wednesday that would limit the ability of Wall Street banks to trade complex financial tools called derivatives.

The folks who print America's money have designed a high-tech makeover of the $100 bill. It's part of an effort to stay ahead of counterfeiters as technology becomes more sophisticated and more dollars flow overseas, Federal Reserve Chairman Ben Bernanke says.

Benjamin Franklin is still on the C-note. But he has been joined by a disappearing Liberty Bell in an inkwell and a bright blue security ribbon composed of thousands of tiny lenses that magnify objects in mysterious ways. Move the bill, and the objects move in a different direction.

In an online poll of a sample size of 21,600 respondents selected from across the globe, 93% or 20,100 of the total sample size had opined that there would be a fall in gold prices due to a recent upbeat mood in the global equity markets, while only 1,400 respondents contradicted the stand, 0.46% did not comment on either side. This showed that most of the respondents believed that there would be a fall in gold prices in the near future due to a recovery in global equity markets.

Starting in late 2011, Ottawa will replace Canada’s paper-cotton bank notes – prone to wear and tear – with synthetic ones that last two to three times longer.

Now that a giant ash cloud from a volcano in Iceland is disrupting global air freight, some manufacturers are finding that this strategy is backfiring. Nissan suspended production at two Japanese auto assembly plants Tuesday and BMW was forced to idle three plants in Germany because of shortages of critical parts. Computer maker Dell is experiencing delays in getting notebook computers to European customers.

The Securities and Exchange Commission is examining whether any of the 19 largest U.S. banks are using an accounting trick that a bankruptcy examiner has said led to the collapse of Lehman Brothers, SEC Chairman Mary Schapiro said Tuesday.

HDFC Bank will sell silver bars during a May local festival for precious metals purchases, the first time ever by a bank, as demand picks up, a top executive of the bank said on Monday.

FASB's reprehensible capitulation has allowed banks to overstate their assets by increasing the value declared on crap OTC derivatives.

NOW the banks, according to this article, are hiding their debt size too.

Now if you overstate your assets and understate your debt you used to go to the clink.

However now it is called a Jobless Recovery.

Review of Bank Closings

Dear Jim,

After taking a break over the Easter holidays, the FDIC got busy again, closing nine banks between 4/9/10 and 4/16/10. Eight of the nine were closed this week.

Collectively, these nine banks had reported assets of about $6.84 billion and deposits of about $5.7 billion. The FDIC estimates the cost of the closings will be about $1.12 billion, about 19% of deposits. Based on that estimate, the bank’s assets are really only worth about $4.59 billion and had been over-stated by 49%.

The FDIC also had to enter into loss-share agreements with respect to $4.06 billion of assets taken over by the acquiring banks. That indicates its eventual losses could greatly exceed present estimates. Since the beginning of this crisis, the FDIC has entered into loss share agreements with respect to about $141.3 billion in assets.

As has often been the case in recent closings, the larger banks were the worst offenders in terms of over-valuation. City Bank of Lynnwood, Washington, had reported assets of $1.13 billion that, based on the FDIC’s loss estimate, are really only worth about $697 million. Bank management had over-valued them by about 62%.

Tamalpais Bank of San Rafael, California, had reported assets of $628.9 million that, by the FDIC’s loss estimate, are really only worth about $406.5 million. They had been over-valued by about 55%.

The largest of the banks closed, Riverside Bank of Florida, Fort Pierce, Florida, had reported assets of $3.42 billion. Based on the FDIC’s loss estimate, they are really only worth about $2.27 billion and had been over-valued by about 51%.

In each of these cases, a look at the bank’s balance sheet would have suggested it was very well capitalized. In reality, each was insolvent and had to be closed at a great cost to the FDIC.

Respectfully yours,

CIGA Richard B.

Goldman Sachs Group Inc. said Tuesday its first-quarter earnings almost doubled to $3.3 billion as its trading business again surpassed the rest of the financial industry. It was a bit of good news for the bank as it faces a government civil fraud charge.

Furniture makers are blaming higher labor and material costs for producing in Asia as well as trans-Pacific shipping fees. Industry insiders expect more news of price hikes after buyers and producers gather in High Point for the world's biggest furniture trade fair that began Saturday.

America's "Great Compromiser" Henry Clay called government "the great trust," but most Americans today have little faith in Washington's ability to deal with the nation's problems.

An early warning system to detect financial problems before they reach crisis proportions must allow policymakers to better pinpoint areas of excessive risk-taking, according to a new Federal Reserve paper released Monday.

"What we did know from the financial crisis is that credit default swaps were a cancer that spread throughout our economy and caused, in part, the credit crisis. So we need to put those on exchanges," says our guest Mark T. Williams, a former Fed examiner and author of a new book,

The Securities and Exchange Commission Friday charged Goldman Sachs with fraud which dragged down gold. Prices have been looking to make a move past the $1,160 area to $1,175 an ounce as momentum buying increased gold's appeal as an alternative asset. However, after fraud charges were brought against Goldman, investors lost their risk appetite and dumped all commodities in favor of the U.S. dollar.

The volcanic ash cloud that has grounded many flights could deal a bigger economic blow to the airline industry than the attacks on the United States on September 11, 2001, the EU's transport commissioner said Monday.

Economic data has been so upbeat in the last few days that economists are pondering an almost-unthinkable question: Could there even be signs of life in the zombie housing sector?

It is a foretaste of what may happen across the world as governments discover that tax revenue, and discover that the bond markets are unwilling to plug the gap. The G7 states are already acquiring an unhealthy taste for the arbitrary seizure of private property, I notice.

President Kirchner has been eyeing the pension pool for some time. Last year she pushed through new rules forcing them to invest more money inside the country – always a warning signal.

Welcome to the Decline and Fall of America where stocks, interest rates, and gold can rise together.

President Hugo Chavez has announced an agreement with China that would have the Asian economic giant devote $20 billion to financing long-term development projects in Venezuela.

Force of the breakout is a function of time and range (or volatility) within the consolidation. The force of the breakout (percentage gain from the breakout point), increases as the time and volatility of the consolidation increases.

The 2008-2009 consolidation was nearly the longest and most volatile. This should give it great force to the upside. To suggest that it has topped out after 7-months and 8.5% rally from the breakout ignores the massive energy stored within the previous consolidation.