The stock market closed out a remarkable 2009 with a loss as investors bet the improving economy will lead the government to pull back on its stimulus measures.

Let's examine the above logic.

Define improving economy here. Core business spending is at best flat-line when adjusted by the understated CPI and declining in gold/stable currency terms.

Source: http://business-money-and-finance.blogspot.com/2009/12/us-economy-orders-claims-signal.html

While real consumption's contraction is slowing, it is still declining in real terms. That's a big deal as consumption contributes over 70% of U.S. Gross Domestic Product (GDP).

Moreover, the minute the government begins to withdrawal it's stimulus measures, the consumption-driven economy will roll over under the force of debt implosion. It is the stimulus (government spending, bailouts, liquidity injections) at the expense of the currency that is pushing up the stock market. Food stamp holders, or today's bread lines will only increase with the removal of stimulus. This is not a politically viable option. Thus, the ever increasing threat of a hyperinflationary depression as most notably discussed by Jim Sinclair and John Williams.

Source: http://business-money-and-finance.blogspot.com/2009/12/shadowstats-john-williams-prepare-for.html

Hyperinflation and depressions are not mutually exclusive as many think. History is riddled with economic decay driven by currency collapses. The most notable is the Wiemar Republic.

Source: http://business-money-and-finance.blogspot.com/2009/12/squawk-box-financial-summit-markets.html

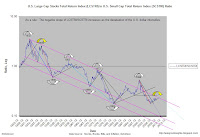

The recent discussions about the need for a equity correction in 2010 on F-TV has many investors worried. As my shades of 1932 commentary illustrated, time is still wrong. The 1932-1933 and 1974-1976, both comparable, gold-adjusted counter-trend rallies, last 15 months and 21 months, respectively. The 2009 rally is a mere 9 months old. Need for a correction? Yes, but time still wrong.

Source: http://business-money-and-finance.blogspot.com/2009/12/shades-of-1932.html

Or, simply follow Jim's advice:

Why short this mess in the banksters sh*t hole when you can own gold?

Can't argue with that.

Happy New Year to all!