Even the absurd can become believable if it is repeated enough times. Many ‘experts’ and talking heads will suggest ad nauseum the economy is accelerating in 2011. They’ll cite key statistical improvements in centrally generated economic time series. The improvements will be cast as “shock and awe” until year end. Simply be forewarned of the transition from economic recovery to acceleration.

Unfortunately, little has changed since the onset of the crisis other than the magnitude of the debt created.

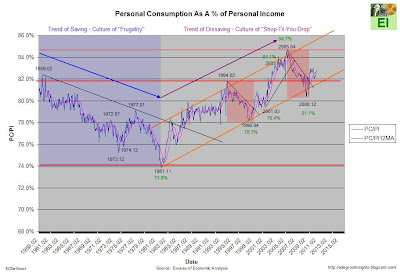

Personal expenditures, or consumption, still represent over 70% of GDP (national income). Excessive consumption fueled by debt got us into this mess, so only logic would dictate that it will get us out if it, right?

Personal Consumption Expenditures (PCE) As A %GDP and Personal Consumption Expenditures As A %GDP Average from 1947:

Ignore the fact that domestic private investment has collapsed levels not seen since the Great Depression. Oops, it’s best we don’t look at that.

Gross Domestic Private Investment (GDPI) As A %GDP and Gross Domestic Private Investment (GDPI) As A %GDP Average from 1947:

Government expenditures and investment continue to their upward trend as consumption inevitably weakens under weight of the debt burdens created under shop-til-you-drop mentality created by the illusion of the plateau of economic prosperity.

Government Consumption Expenditures and Gross Investment (GCEI) As A %GDP Average from 1947:

The cold reality is that Americans, driven by the instinct of self-preservation, are beginning and to save more. Ultimately, the trend towards thriftiness, while curtailing consumption and redistributing the drivers of economic growth to centralized QE and stimulus, will provide the fuel for the next economic expansion.

Savings (SAV) As A %GDP and Savings (SAV) As A %GDP Average from 1947:

Headline: Economy grew modestly in July-September quarter

The economy grew at a moderate pace last summer, reflecting stronger spending by businesses to replenish stockpiles. More recent barometers suggest the economy is gaining momentum in the final months of the year.

Gross domestic product increased at a 2.6 percent annual rate in the July-September quarter, the Commerce Department reported Wednesday. That's up from the 2.5 percent pace estimated a month ago. While businesses spent more to build inventories, consumers ended up spending a bit less.

Source:

finance.yahoo.com